(Editor’s note: Confused about why you can use PIN cards in the Netherlands but often can’t use cash, yet you need cash for many transactions in Germany and can’t use PIN cards? So are we. This post about the latest digital banking and payment options is the second installment in an expat financial services series and will be updated with new FinTech and services. You can read the first installment here.)

If you, like me, have ever left a bank dazed, confused and angry after trying to open an account or fix a credit card issue, then you know we expats are the ugly stepchildren of the financial world.

Expats often don’t live anywhere long-term in the conventional sense that bankers like their customers to live. We move around. We travel a lot. Worst of all, we often don’t have conventional income sources or even “jobs” since we’re likely to be entrepreneurs, investors, global consultants or “other” on those forms they give you to fill out.

But lucky for us, technology has changed everything in the banking world … and made our lives easier. The Internet begat e-commerce, and e-commerce has led to a new category of virtual online-only banks and FintTech concepts.

Some of this is also driven by consumers wanting greater cybersecurity, with conventional credit cards and banks failing miserably over the years.

Bunq

This Amsterdam-based virtual bank has exactly what expats need … a way to open new accounts without a tax number. I personally ran into the brick wall of not being able to set up personal accounts when we first moved to the Netherlands because I was still on my 90-day tourist visa and hadn’t gotten my BSN tax number. Oh, and all my credit cards were cancelled except my American Express. My American banks were sure someone had stolen my credit cards even though I’d informed them in writing I would be in Europe long-term. (Don’t get me started.)

Bunq offers the “fully mobile expat bank account” you only need a phone and a valid ID to open.

Founded in 2015 by Canadian entrepreneur Ali Niknam, this fast-growing startup has gone from a few hundred thousand in assets to about 700 million euros. And in case you forgot, “assets” in banking are interest-generating loans, not deposits, which are booked as liabilities.

With B2B e-commerce transaction pioneer Adyen and other products, the Netherlands is suddenly a leader in FinTech.

– Terry Boyd

MB WAY

Liina Edun just wrote a post about banking and financial services in Portugal, and she was mightily impressed with MB Way, a mobile app that connects users to Multibanco, Portugal’s interbank network operated by Sociedade Interbancária de Serviços S.A. Almost all of Portugal’s banks and global financial payment systems such as PayPal are connected to the MB WAY platform.

It has multiple convenient uses:

• You can easily send to or request money from people in your phone contact list.

• You can pay your bills and make payments to service providers.

• You can create a one-time only card via the app to buy something online safely.

• You can withdraw money from the ATM using your MB Way app if you don’t have your bank card with you.

• And you can make purchases from physical stores.

The app and all of its operations are free. The only requirement to use the MB WAY app is to have a Portuguese phone number and a Portuguese bank account.

Klarna

Stockholm-based Klarna is a buy-now, pay-later platform for e-commerce that’s seen massive adoption since 2019. So, how is that different than a credit card? For one, Klarna doesn’t charge 17-percent annual percent interest on balances like most of the popular credit cards.

Klarna offers three consumer options – pay in installments, pay in full in 30 days or finance a larger purchase over as long as three years, which does involve an APR of 19 percent. In most transactions, the retailers pays Klarna a small fee, because Klarna is driving sales to them they might not ordinarily get.

Consumers get fed sales at H&M, IKEA and various Klarna clients that other people don’t see. The virtual bank now has more than 200,000 retailers signed, at least 15 million users in the United States alone, 3,500 employees and users in 17 countries. We hear a ton of buzz from our expats about Klarna.

In a relatively brief time, the business model has made the 16-year-old mega-unicorn Europe’s biggest privately owned Fintech company, according to Politico.

Caveat emptor

European regulators are noticing young consumers racking up billions of dollars in debt outside of financial regulations, so look for new rules and spending limits.

N26

In the seven years since it was founded, this Berlin-based virtual bank has disrupted the financial sector and led to more competition for conventional banks, which is a good thing. It has attracted investments from mega-players such as Peter Thiel, who co-founded PayPal, Facebook and Palantir as well as from Tencent, the Singapore Sovereign Fund and Munich-based insurer Allianz. So this is the real deal.

The big selling point of N26 for expats is that you can open an account with far fewer hoops to jump through. At conventional banks in the Netherlands, for example, you must have a BSN number, which you get at the city hall, proof of address (which can’t be a hotel or temporary housing like Holland2Stay), and an ID.

By comparison, read here how Eindhoven-based expat entrepreneur Rachel Arts quickly and painlessly opened an account just after moving to the Netherlands from the United Kingdom.

N26 has 7 million customers/subscribers and is offering more and more services, including accounts for entrepreneurs.

Oney

Based in Lille, Oney is a popular fractional payments platform in Spain and France and available in other European countries including Germany, Portugal, Italy and Belgium. This is sort of a localized Klarna. Oney allows you to split your credit card payments without paying interest.

This is not a new company, founded in 1983. But in the past few years, Oney has expanded quickly. Oney Bank majority owner is Groupe BPCE based in Paris.

Revolut

Like Klarna, five-year-old Revolut is another FinTech unicorn – it’s the UK’s most valuable FinTech company – that’s attracted lots of publicity and lots of investment. Based in London, Revolut just applied for a banking license as it competes against N26.

While you can’t “bank” with Revolut in the conventional sense, and your deposits aren’t insured, you still get debit cards and can make purchases, transfer money ands split bills. The Revolut app includes money management and budgeting tools and spending tracking.

Revolut’s big push now is into making it possible for customers to trade equities and invest in cryptocurrencies and commodities such as gold and silver.

Revolut currently has 13 million customers and a valuation of $5.5 billion. TechCrunch has a solid post about future plans.

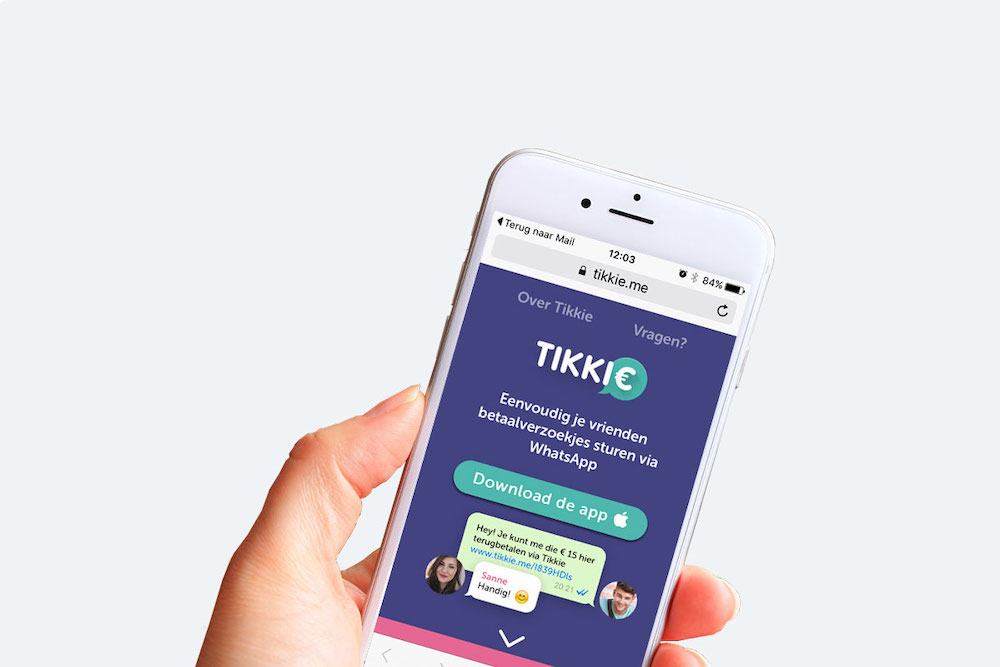

Tikkie

This is a cool mobile payment app developed by ABN AMRO, the giant Amsterdam-based bank. Tikkie allows you to pay for services and items on demand. For example, we recently ordered tikka masala from a pop-up restaurant in someone’s home (legal in the Netherlands) and got a payment request just after we picked up our meal. We immediately paid it. Easy-peasy. The family got paid without having to get payment tech and we got our food pronto.

If you’re splitting a restaurant bill, you can send your friend a Tikkie to pay their share. This app is so popular that 7 million people use it including Dispatches staffers and executives in the Netherlands.

We’ll have more about FinTech including a look at personal-finance tools such as Nerdwallet.

You can read more here in our FinTech archive.

You can read more here about credit cards in our archive.