(Editor’s note: We know personally expats who’ve inadvertently racked up tens of thousands of dollars in medical expenses during trips to the United States. This post includes tips on how to keep that from happening to you.)

A few months ago, I held my son on a hospital bed in the United States. Concern for my son was first and foremost on my mind, but another thought kept creeping in: How much will this cost? As an expat with no U.S. insurance, I tried not to think about how much the visit would cost and whether my Dutch insurance would reimburse our medical expenses fully.

I was beyond caring.

My son’s temperature spiked on the first day of our trip, accompanied by labored breathing and total listlessness. A visit to an urgent care clinic led to a referral to the hospital and a diagnosis of pneumonia. After a steroid, a dose of antibiotics and three breathing treatments, he perked up and his oxygen saturation improved enough to send him home.

I remember sitting on that emergency room bed for five hours, glad I was getting the medical attention needed for my son but wondering how much medical expenses would cost.

I had no visibility into the total cost and days later, I still didn’t know.

Vague bills

After a week, the bills started to come.

One bill came directly from the hospital for $800 in expenses. “Wow, that’s cheap,” I thought, but I congratulated myself too early. A few days later, a separate $30 bill came for X-ray services and a few days after that, I found myself looking at another $1,000 bill from a company called U.S. Acute Care Solutions.

It had no description other than “emergency department visit.” But I already got the bill from the hospital, I thought. It took some poking around online to find out that this was a separate bill for privately-contracted physicians who work at the hospital.

So, after the $200 urgent care visit and the $90 follow-up pediatric appointment, we racked up more than $2,000 in medical expenses, all of which I had to pay out of pocket. The funny thing is that the prescription medicine was just a blip in the expenses at just under $20.

It could have been worse

All in all, despite the annoyance over the separate billing and the hospital’s inability to tell me if any more bills were coming my way, I thought this was “cheap” compared to horror stories I’d heard of U.S. hospital visits.

Fast forward a few weeks and a reimbursement claim to my insurance company, I was ecstatic when I saw a big deposit in my bank account. My Dutch insurance had reimbursed every cent of my son’s medical expenses in the U.S.

As an American who visits family often, I know the risk is always there for unexpected illnesses and accidents. I’ve always prepared and chosen to pay for more coverage in my Dutch health insurance so medical expenses abroad are covered at foreign rates.

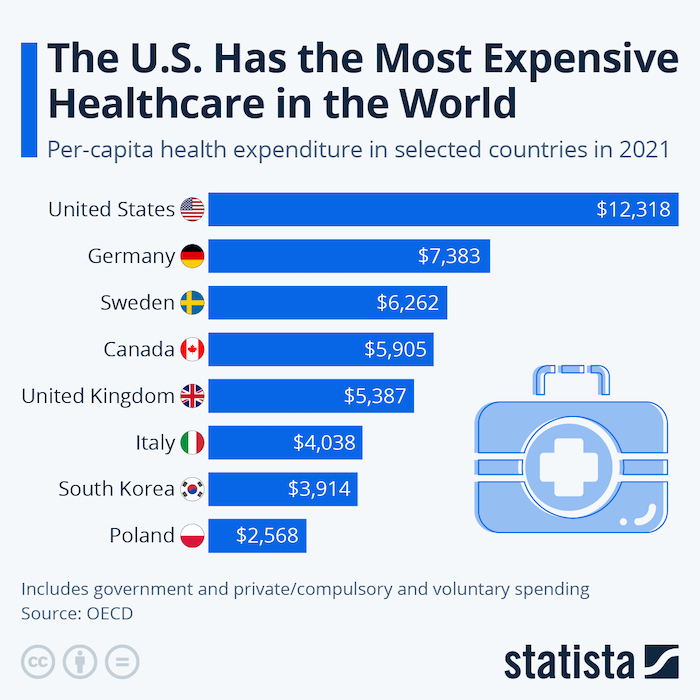

This is vital for visiting the U.S., where one trip to the hospital could spell financial ruin.

In that hospital room, I had assumed the expenses for my son’s visit would be covered, but I wasn’t 100 percent sure. I had tested it a bit in the past with an urgent care visit, but $200 is different from $2,000. After all, you never know what fine print you didn’t read in your insurance policy.

This was a success story, but it’s still a cautionary tale to always think ahead and protect yourself.

No one wants to get hurt or sick while traveling, but we can’t always prevent it, especially with accident-prone and illness-ridden children. Vacation isn’t a shield from illness or bad luck.

Protect yourself

If you are someone who travels to the U.S. — for family visits or work — here are some practical tips to protect yourself from unexpected medical expenses abroad and what to do if they occur:

• Find out what international expenses your regular health insurance covers. If it is offered, choose to pay a bit more every month and protect yourself from unexpected medical care. If you live in the Netherlands, the basic plan covers international medical costs at the equivalent Dutch prices. This might be fine in many other countries, but if you end up sick in the U.S., you’ll be screwed. Choose the plan that covers expenses at the international country’s price.

• Choose an additional travel insurance policy that covers medical expenses for your U.S. trips. Short-term policies are available for purchase just for the duration of your trip.

• If you do have medical expenses, always get the itemized bill and not just the credit card receipt. Most insurances won’t accept just the credit card receipt without a description of services rendered.

• Take photos of any injuries, especially if they are minor (like a cut or wound). This is just to cover all your bases. It never hurts to plead your case to your insurance company.

• Make sure you don’t leave any bills unpaid. Leave a local address of someone you trust so you make sure you receive any straggling bills after you’ve left. It’s always hard to know if you paid everything, especially with all the separate bills.

–––––––––

Read more about the pitfalls of U.S. healthcare system here and here.

Lane Henry is an accidental long-term expat. She is an American who came to the Netherlands for two years—or so she thought. She has now lived in the Netherlands and explored Europe for over a decade.