It’s 2024 and the big news is … Brexit. For all the wrong reasons, one of which being at least some British people are waking up to the fact they were sold a bill of goods by extreme nationalists, with the bill coming due in the form of a shrunken, stalled economy. A 2023 poll indicates the majority of British voters – 56 per cent – believe Brexit has made Britain’s economy worse.

With the eighth anniversary of Brexit approaching, it seemed like the referendum took place several lifetimes ago, so we’d forgotten most of the early details. But way back in 2015 and 2016, brave Brexiteers Nigel Farage, Arron Banks and Boris Johnson were leading us to the Elysian Fields of a United Kingdom liberated from the velvet tyranny of the European Union.

A few business leaders and economists tried to inject reality into the Brexit debate with warnings about the huge dent Brexit would put in the UK’s economy, but they were quickly shouted off the stage with cries of “Remoaners!” and “Operation Fear!”

Alas, business people operate on objective analysis and empirical data while Brexiteers were selling a feel-good return to Britain’s glorious past … which has turned out to be the stiff upper lip England of shortages and sacrifice that followed World War II.

So, we’ve created a regularly updated post documenting the glory as unrelenting waves of greatness wash over the British Isles:

• Back in 2016, the Brexiteers sold Brexit as a panacea for everything that was wrong with the United Kingdom. Then, the pro-Brexit press, particularly the Express, predicted the remaining EU countries would start to leave one-by-one, coining hopeful new words such as “Grexit” and “Nexit.” Well, all these years later, Nexit could be come a reality as Dutch far-right politician Geert Wilders is working behind the scenes to free the Netherlands from EU tyranny to stop all immigration.

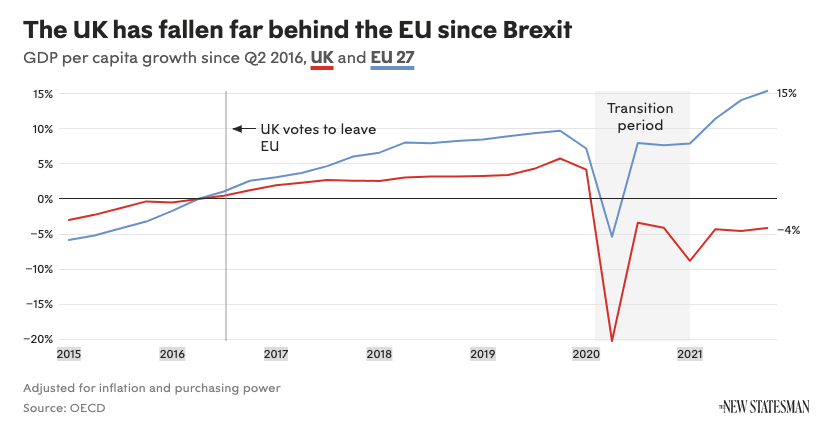

If we could get Mr. Wilders in a room, we might point out how Brexit has been a series of economic disasters for the UK, not a panacea. In a report earlier this year, Wall Street financial giant Goldman Sachs found the UK’s real GDP per capita has barely risen above pre-Covid levels and stands 4 percent above the mid-2016 level, the report found. That compares to 8 percent for the Euro Zone and 15 percent for the U.S. economy. As the economy stumbled, British consumer prices have risen 31 percent since mid-2016 compared with 27 percent in the U.S. and 24 percent in the Euro Zone.

And all those exciting new trade treaties the “Singapore-on-the Thames” has fashioned across the globe … don’t come anywhere close to offsetting diminished trade with the world’s largest trade zone. Even the Brexit mouthpiece Telegraph admits that all these years later, the UK is still heavily taxed, mired in debt, with public services that don’t work and a huge housing shortage.

Some panacea ….

• One of the biggest Brexit complications was the UK’s relationship with Gibraltar, the British Overseas Territory on the southern edge of EU member Spain, and far, far from Old Blighty. The Spanish wanted it back. The British said nay. But you’re thinking, “Come on … that must be settled after all these years.”

De lo contrario, amigo.

For now, workers just drive into Gibraltar every day and the British run the airport and other key infrastructure. If there is no final treaty, there could be border checks everyday, with control of the airport in a power-sharing agreement that Brits say would be a security issue and a violation of the spirit of Brexit, which eschews any cooperation with Europe as a violation of sovereignty.

The Independent has the best post.

• Seven years after the referendum, the real Brexit is finally here. Not the Brexit of blue passport covers and truncated vacations in Spain. As of 31 January, food and fresh flower imports from the European Union are subject to new Brexit customs controls, adding more than 330 million pounds per year to the cost of trading with European Union and forcing up the price of food for Brits.

The introduction of these controls have been delayed at least five times because, well, they’re insane.

And guess what … the UK still isn’t ready. Financial Times has a post about when the inspections go live on 30 April, no one can say for certain the process will work. Everyone including food importers are warning the system isn’t ready.

“Dutch export industry bodies, which tested the facility late last year, warned in January that the checks were ‘a disaster waiting to happen.’ They said last week that their concerns remained unchanged and they fear ‘huge traffic jams’ as inspections ramp up,” according to Financial Times.

Will the facilities on the UK side be open 24 hours? Will there be sufficient inspectors? No one knows!

Sigh.

• Politico has a cheery little post about how Boris Johnson spent 8,000 pounds of public money on booze for his party marking the formal exit of the UK from the EU. That included by our calculations 7,605 pounds for 117 bottles of a faux Champagne from West Sussex in the south of England and a few bottles of red wine from Italy.

• Remember all those glorious new trade treaties the UK was going to sign once it was freed from the shackles of the EU? Well, the Brexiteers would prefer you forget. A tentative deal with Canada just blew up, according to CNN. The talks started in March, 2022 and produced, well, nothing. So, UK automakers – which currently pay low or no import taxes when exporting to Canada – will face much higher taxes come April 2024. UK farmers selling to Canada face paying huge tariffs on the value of meats and cheese.

• Twenty twenty-three, seven years after the referendum, was big year for Brexit, with the European Union’s scheduled introduction of its biometric entry system last October. The system has been repeatedly delayed and of course no one knows how it will work in British ports of entry such as Dover and the Eurotunnel. For policy wonks, Financial Times has an extremely granular breakdown of where all this is headed, with details that would make details-adverse Donald Trump’s head explode. The FT post postulates that while a likely Labour victory in general elections this year will bring the United Kingdom and European Union into closer alignment on trade and other issues, Labour is unlikely to waste political capital trying to reverse Brexit.

• Politico is reporting that new rules requiring foods to carry “not for EU” labels are causing confusion on the part of British shoppers, with experts warning the new policy risks suggesting the items are produced for the EU to lower standards. In reality, the labels are required for meat and some dairy products moving from the UK to Northern Ireland as part of the Windsor Framework, meant to ensure goods don’t go into the Republic of Ireland, an EU member country.

But British consumers believe the stickers mean the food is below EU standards.

From that post:

Posting a picture of a pot of chicken liver parfait, a dismayed Tesco shopper asked: “Does that mean [it’s] made to a lower standard?” While yet another complained: “I recoil each time I see food in supermarkets with the label: not for EU.”

Whatever the promises of Brexit, it’s always British consumers who seem to be paying the penalty for leaving the world’s largest trade agreement.

• Despite all the negatives for Brits themselves, there are some big Brexit winners. Specifically, Egypt and Morocco. Imports from EU food producers are now too expensive, so British markets are now stocking goods from North Africa and the Middle East, according to far-right media outlet The Express. Between 2018 and 2022, imports of Egyptian fresh, dried and frozen fruit and vegetables increased by 150 percent, In Morocco, the increase was almost 200 percent.

• The percentage of Brits who rate Brexit a dismal failure is growing. About 62 percent of Britons believe Brexit is a failure according to British polling company YouGov, up from the low-50s just a year ago. However, no one is in a hurry to have another referendum. YouGov polling indicates a substantial majority supports a new E.U. referendum within the coming 10 years, with 46 percent saying there should be compared to 36 percent saying there should not. Though Boris Johnson might not live to see the U.K. rejoin the E.U., his children (legitimate and illegitimate) certainly will.

• Brexit is breathing new life into Scotland’s independence movement. New Scottish First Minister Humzah Yousaf, who replaced the disgraced Nicola Sturgeon, told supporters in early September that that the Yes movement can help correct the damage of Brexit, which he called “an historic wrong, according to the BBC. Scotland, like the rest of the United Kingdom, is dealing with a cost-of-living crisis, a crisis that won’t end as long as Braveheart country is still subject to Brexit, Yousaf said.

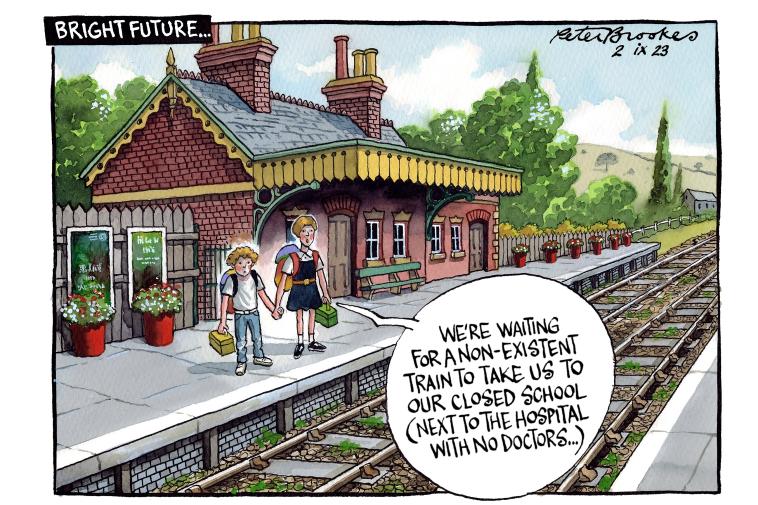

• It’s not just Brexit. Brexit regret is just one element haunting a struggling UK, which is at a inflection point not unlike the General Strike of 1926, 1956 and most of the ’60s, ’70s and ’80s and, well, you get the picture. Public services are foundering including rail and the NHS. The economy is on the rocks. Inflation is such a problem that the government has delayed health and safety checks on food imports from the EU for the fifth time in three years amid fears that extra controls will increase food prices and lead to shortages, according to CNN. Schools made out of shoddy concrete are collapsing.

It’s so bad that the conservative Times of London, which supported Brexit, ran a cartoon (above) about the sense of ennui sweeping Old Blighty.

• Brexit, as we all know now, was about nostalgia and xenophobia. To understand the origins, you have to understand English popular culture. In “Downton Abby,” for example, there’s a great scene where Robert, Earl of Grantham, says ” … there always seems to be something of Johnny Foreigner about the Catholics.” And who is more “Johnny Foreigner” than a European?

To that point, the Guardian has a post about how classic 1960s British TV series were full of hints about the sense of identity and political culture that contributed to the vote. Which isn’t hard to understand given that the UK had (barely) survived a war with Germany and its allied forces drawn from all around the continent. Of course, Europe long ago moved on. Britain … not so much.

• The Brexit ironies never cease. Not the least of which is the UK is retaining most of the inherited EU laws Brexiteers found so oppressive while losing right of travel to the EU and other freedoms. Of the estimated 3,200 pieces of EU legislation which were automatically added to the UK statute book after Brexit, only 800 will be scrubbed as of 31 December, according to Politico.

• We never understood how the United Kingdom cutting itself off from a market of 500 million European consumers was going to be a good thing. Turns out, it wasn’t. The Guardian has a post about how at least 100 British craft beer companies have gone out of business. Once the UK brexited, exporting to the European Union became expensive, with import duties and time-consuming paperwork requirements. “It just got too much – Brexit,” the post quotes the founder of Bone Machine Brewing. “We were heavily geared for export. We’d be selling to Finland, Sweden, Norway, Ireland, Netherlands, Italy, Spain. We had Hungary in the pipeline. And it all disappeared with Brexit.” Brewers weren’t the only sector to suffer. Sotheby’s UK profits dropped 25 percent in 2022, largely due to Brexit.

• Isn’t it ironic, don’t you think? One of the top executives at the Daily Mail, the major Brexit cheerleader, has admitted that Brexit has hit the newspaper hard, with advertising revenues declining due to the United Kingdom’s lagging economy. Which the executive admitted was due at least in part to Brexit. A post in the rival left-wing Independent states the Daily Mail published the most pro-Leave articles in the run-up to the vote of any UK news outlet.

• Isn’t it ironic, don’t you think? Pt. 2. Michael Gove, one of the Brexit Bros along with Boris Johnson and Dominic Cummings, told an on-going inquiry into the COVID disaster that preparing for a no-deal Brexit helped the UK prepare for the pandemic. Civil servants “honed and refined” crisis skills as they worked up ways the UK could leave the EU, Cummings said. This was, of course, the opposite of what others said … that Brexit was a distraction to pandemic planning. And honestly, we don’t remember COVID as a Battle of Britain victory for the British Isles, but a confusing series of lockdowns followed by scandals as British officials including Johnson and Cummings flaunted restrictions they imposed on their countrymen. That and the fact that Britain – population 67 million – had far more deaths (228,000) and a higher rate of deaths per 100,000, than Germany, population 83 million, with about 175,000.

• Seven years after the Brexit vote, everything Dominic Cummings et al promised has come true. After leaving the European Union, the United Kingdom now is pumping 350 million pounds per week into the the National Health System. The UK has bold new tariff-free, bureaucracy-free trade treaties with the United States and other global economic dynamos. Unfettered by draconian EU rules, the British economy is now the envy of the world, with GDP growing at 5 percent per annum. The UK is free of all EU rules and laws. Britain’s auto industry and financial services industry now dominate the world. And even though the UK left, it maintains close cooperation with the EU on security, research and education.

Kidding.

None of those things happened. Not. One.

• Sure, it made the nationalists feel better. Still, by any empirical measure, Brexit is a disaster. But what if it was supposed to be? What if it was supposed to perpetuate English aristocracy while putting the proletariat in its place? Let’s ask that Wodehousian symbol of all that is regal in the UK, Jacob Rees-Mogg. Who, by the way, is now Sir Moggy. He was knighted by Boris Johnson as part of something called a “resignation honors list” that Johnson received as a parting gift after being deposed as PM and resigning his seat in the House of Commons. In the Daily Mail, which proudly represents the lowest common denominator in British society, Rees-Mogg writes that Johnson will return as leader of the Conservative Party, which one assumes would put Boris on course to return as PM. Is it our imagination, or is Moggy Jeeves to Boris’s Bertie Wooster?

• We’re adding another issue to the list of things that definitely, 100 percent have nothing to do with Brexit. In April, the UK’s food inflation was higher than the European Union average of 16.4 percent, and higher than all the major European economies, according to the BBC. One reason is lack of labor to harvest the basic ingredients such as wheat and corn, which comes back to the UK ending freedom of movement. Dispatches is headquartered in the Netherlands, where labor from Eastern Europe and the Balkans is crucial.

• Well, this settles it … Nigel Farage has pronounced Brexit a failed experiment. But wait … it gets worse. The august English statesman, who once deemed Donald Trump “the bravest man I ever met,” says British politicians are no better than the little dictators in Brussels. And he admitted that the United Kingdom has not benefitted from Brexit. “Brexit has failed,” Nigel said, according to Politico and about a hundred other pubs. “We’ve not delivered on Brexit and the Tories have let us down very, very badly.” Now, the question becomes, if one of the main instigators admits Brexit was a huge mistake, yet no one does nothing about it, does that say more about the UK’s perpetual stasis than Brexit itself?

By the way, Nigel’s critics on social media are reminding the world that Farage said he’d leave the UK if Brexit was a bust. We’re guessing he’s packing for Mar-a-Lago as we speak.

• Vauxhall’s parent company Stellantis is calling for a renegotiation of the Brexit deal to save its British factories. Brexit complicated how Vauxhall sources components, with the car maker facing steep tariffs. Add to that the inability of the UK to create its own EV battery supply chain, and all the predictions that Brexit would kill the British auto industry are coming true. Sky News has the best post.

• With the coronation of King Charles III, a nice dichotomy is emerging. Charles is reputed to be one of the richest people in the world, worth about $2.3 billion, according to the Guardian, though that figure is up for debate. Still, he’s one of hundreds of Windsor royals. At the same time, the Bank of England’s top economist, Huw Pill, told ordinary British people they need to accept the fact they are poorer and stop asking for pay raises, which economists blame for inflation. Okay, we overuse this phrase, but, “We can’t make this shit up.”

What does this have to do with Brexit?

Well, the Brexiteers sold leaving the European Union as a panacea. So far, it’s been all down hill for the British economy while the rest of Europe is flourishing. That, and it points out the Brits willingness to remain in a perpetual state of serfdom, sending billions to the The Crown while the average household British incomes dropped 0.6 percent in 2022 from fiscal year 2021, based on estimates from the Office for National Statistics Household Finances Survey. Food inflation in the UK is running at 19.1 percent a year, the highest level in 45 years. So we’re guessing poor Charlie rushed back to his beloved gardens and farms immediately after being crowned.

• A growing number of tech companies are choosing to list on American stock exchanges rather than in London. Cambridge, England-based chip designer Arm chose New York for its IPO, estimated at $10 billion, because Brexit has diminished the UK standing in the international community, according to Aim founder Hermann Hauser, who’s Austrian.

• You might not have heard (because no one is really talking about it), but freed from the oppressive yoke of the European Union, the United Kingdom scored a huge trade deal, joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. This trade bloc includes 11 members: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, Peru, New Zealand, Singapore and Vietnam. (The United States was a member, but Donald Trump withdrew back in 2017.)

The reason no one (certainly not the Brexiteers) is talking about this huge deal is that it will add precisely 0.1 percent to Britain’s GDP.

In aggregate.

During the next 15 years. Well done!

• UK Home Secretary Suella Braverman provided a bit of comic relief when she stated unequivocally that Brexit was not the cause of 18-hour-plus waits at the Dover crossing into the Continent. Then, Prime Minister Rishi Sunak’s office confirmed uncoordinated post-Brexit processes on both sides of the border were indeed contributing to the madness. Post-Brexit, French officials now manually inspect and stamp every passport as passengers exit the UK, which required time. Duh. The Dover mess is just another example of screw ups that most certainly have nothing to do with Brexit. (See more below.) How dare you even think that.

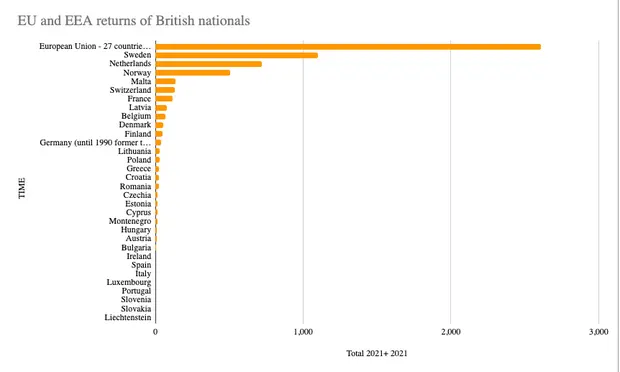

• The Guardian has a new post naming Sweden as the undisputed champion when it comes to expelling Brits post-Brexit. Citing official European Commission statistics, the Guardian states that Sweden has expelled 1,100 British nationals since Brexit, more than any other country in the EU. Those Brits declared persona non grata failed to secure long-term residency visas. The Netherlands came in second, expelling about 700 Brits. Spain, Italy, Portugal, Slovakia, Slovenia and Luxembourg trailed the field with zero expulsions.

• The latest theme in the far-right British media – the Telegraph, the Express, etc. – is “well, it’s definitely not because of Brexit.” The British economy is the only G7 economy still shrinking. Definitely not Brexit. It was the pandemic and the lockdown, says Jacob Rees-Mogg, former MP for the 18th century. Though, we don’t recall the United Kingdom being the only country affected by COVID-19. That London has lost its dominance as a financial center along with a lot of big equities listings, banks and headquarters in the intervening six years since Brexit is definitely not because of Brexit. The fact business has migrated to Amsterdam, Paris and New York is just a coincidence. And those food shortages that are the worst in England since World War II? Most definitely not because of Brexit. The empty shelves are due to the rain in Spain staying mainly in the plain. Though oddly neither Spain nor the rest of the EU is experiencing any food shortages at all. Exactly why the UK has become such an unattractive place to live and do business remains a mystery ….

• At the third anniversary of the United Kingdom leaving the European Union, It’s hard to imagine than any major economy could have fallen this far, this fast. Week after week, the evidence piles up that the United Kingdom is staggering under the weight of Brexit, weak leadership and a baffling lack of vision. And maybe that’s what we’re all missing.

What if Great Britain’s great problem isn’t Brexit? What if Brexit is only a symptom of the inevitable decline that – in the end – claims all empires? Hence, the halving of the number of students from the EU going to British universities. The declining number of startups coming out of the UK, which has the two best universities in the world in Oxbridge. The 330,000 shortfall in workers after all the EU citizens left. The bottoming out of the UK’s auto industry, once the largest in Europe. The UK’s economy contracting at the same time EU economies are rebounding.

Instead of turning to the hard work of building a competitive 21st century economy as the Dutch, Danes, Germans and French are doing, Boris, Nigel et al decided the way forward for the UK was to go backward to an imaginary Arthurian ideal.

• How do you know Brexit is the worst decision by any country in Europe in the past 50 years? When the media outlets that supported it now are editorializing about how it’s all gone wrong. Or about the incompetence of Brexiteers. Or they quit writing about it at all.

For instance, the Times of London has a recent opinion post with the headline, “The real Brexit challenge is to avoid the situation getting even worse.” Also in the Times, pro-Brexit businessman Alan Hickman conceded Brexit isn’t working.

The Telegraph has a post about the UK’s incompetent ruling class (read, Conservatives) “squandering Brexit’s opportunities. The most recent Daily Mail piece was a mind-numbingly convoluted propaganda post about Boris Johnson going on some TV show and warning that the UK could “fall back into the gravitational pull of the EU.” We can only hope.

• In early 2023, and almost seven years after the Brexit referendum, the Economist, the BBC and other media were trying to assess which was worse for the United Kingdom – the pandemic, or Brexit. Brexit won because it’s permanent, leading to staffing shortages and problems importing goods from suppliers in the European Union. And while COVID-19 is largely in retreat, Brexit will only get worse as the UK will strip out more EU regulations over the next few years by the terms of the final agreement, which went into effect on 31 December 2020.

From a BBC interview with manufacturer in Dorset:

Brexit has been the biggest ever imposition of bureaucracy on business. Simple importing of parts to fix broken machines or raw materials from the EU have become a major time-consuming nightmare for small businesses, and Brexit related logistics delays are a massive cost when machines are stood waiting for parts. We used to export lesser amounts to the EU, but the bureaucracy makes it no longer worthwhile.

For the record, the UK has been the only Group of 7 economy not to have returned to its pre-pandemic size. “The most plausible reason as to why Britain is doing comparatively worse than comparable countries is Brexit,” according to L. Alan Winters, co-director of the Centre for Inclusive Trade Policy at the University of Sussex, CNN reports. If ordinary people just keep making sacrifices, the UK will triumph soon, say diehard Brexiteers. Brexit, it seem, is like Marxism – certain in its prediction the promised prosperity is just around the corner.

• If you think Keir Starmer and Labour will ride to the rescue like John Wayne in the Westerns, you’d be wrong. In late 2022, Starmer said there’s “no case for going back to the EU or going back into the single market”, only “a very good case for making Brexit work,” channeling Theresa May. Labour also ruled out any return to the E.U.’s customs union. So, the UK seems doomed by the current political leadership to become Cuba.

• The Guardian has an entertaining post on the Bad Boys of Brexit – the five political bomb throwers who instigated the original campaign. As predicted, they’re all left the scene, either voluntarily or involuntarily, enjoying the chaos they created from the sidelines.

• Oh, the humiliation. Paris replaced London last November as the largest stock market in Europe, according to Bloomberg. Bloomberg calculates the aggregate value of British shares now stands at approximately $2.821 trillion (2.3 trillion pounds), while France’s are worth approximately $2.823 trillion.

French luxury goods company LVMH is the most valuable, with a capitalization of $360 billion. But unnoticed in all the financial chaos is that Royal Dutch Shell is now a British company, and one of the more valuable ones, at that.

• Brexit was supposed to be about, among other things, jump-starting the United Kingdom’s economy by breaking away from the all the restrictions and requirements of the European Union. The UK would be free to pursue new and more lucrative trade agreements independent of those bureaucrats in Brussels. Well, that rarely happened. And when it did happen, the deals were shite, as Brits are wont to say.

Experts, including former Johnson government officials, are lining up to poke holes in the UK’s post-Brexit trade agreement with Australia, the first negotiated outside the EU. And, by the way, negotiated by Liz Truss, also known as the PM with the briefest tenure in the 300-year history of the office. Former Conservative Environment Secretary George Eustice said Truss’ deal sucked. Well, not exactly those words, but Eustice describes the deal as giving away the farm, so to speak, for the British ag sector, and getting much too little in return.

• Along those same lines, the man who replaced Truss as prime minister, Rishi Sunak, is now talking about an Austerity Budget – raising taxes and slashing government funding – to see the UK through the recession it’s already in.

The Financial Times has an interesting take on that.

Michael Saunders, a former top Bank of England policy maker, warned that the UK’s whole economy had “been permanently damaged by Brexit,” according to the post, which references Saunder’s interview with Bloomberg TV. “If we hadn’t had Brexit, we probably wouldn’t be talking about an austerity Budget this week,” Saunders said. “The need for tax rises and spending cuts wouldn’t be there if Brexit hadn’t reduced the economy’s potential output so much.”

• Which came first, the Boris or the Brexit? That’s the question, isn’t it? Without an odd, unfocused character such as Boris Johnson, would Brexit ever have happened? But did the dark, chauvinistic forces that would later manifest themselves as Brexit shape Boris? And why does the United Kingdom have a such a dysfunctional generation of nihilistic leadership? Blindly ambitious Liz Truss, who so desperately wanted to liberate the richest Brits from taxation while reducing state functions to the barest services. Boris Johnson, the feckless man-child who couldn’t obey his own COVID rules. Nigel Farage, who is happy to see the UK’s economy shredded to sate some deep-seated hatred of Europe. Theresa May, the least charismatic leader the UK ever had until Truss, and the person who believes anyone who thinks they’re a “citizen of the world” is a citizen of nowhere. What dark forces shaped these populist “leaders”? Their legacy? They’ll be remembered as the people who accomplished what even Hitler and Napoleon couldn’t do … divorce the United Kingdom from a Free World that needs it to be stable and prosperous in the face of rising authoritarianism. Now the question is, is there anyone who can undo all the damage?

• After six years of Brexit chaos, you can’t blame Brits who might want to flee to a more stable – not to mention sunnier – Spain. Of course, Brexit has made that a lot more difficult. Fewer Britons are making the move because Brexit has made leaving the European Union fraught with bureaucratic red tape. In fact, in the dark pre-Brexit days of 2012, there were about 400,000 Britons registered in Spain. In 2022, the number dropped to about 290,000.

• Stop us if you’ve heard this one: Remember when the United Kingdom was going to become Singapore-on-the-Thames, making trade deals around the world on its own terms?

The first was going to be with the United States, where the president in 2016 was a like-minded populist fawned over by Nigel Farage, who called Donald Trump “the bravest man I ever met.” Unfortunately, Trump has a habit of never following through on promises. In fact, in 2019, the Trump Administration imposed a 25-percent tariff on Scotch whisky.

Fast forward to late 2022 and a trade deal with the U.S. is still dead. Remainer-turned-Brexiteer-turned ex-Prime Minister Liz Truss admitted not only that there won’t be a deal for years, but there aren’t even on-going talks on the agreement Brexiteers claimed would be the biggest benefit of leaving the E.U.

• One tangible way to measure the success that is Brexit is increasing amount of sewage on British beaches now that the UK freed from the Draconian restrictions of European pollution restrictions. British officials have used that freedom wisely and turned a blind eye to uncontrolled dumping, resulting in contamination of some of the most popular beaches.

It turns out that pollution doesn’t stay where it’s dumped, which French officials have noticed as it seeps into their fisheries. It also turns out that polluting European waters is a violation of the “protection and preservation of the marine environment” clause in the Brexit agreement. The irony is that EU officials are threatening to sue, but not the British cities affected. And that’s what a return to greatness is all about.

Nothing screams freedom like swimming in your own sh*t.

• The latest moment of greatness Brexit has conferred on Rule Britannia involves eight-hour-long lines (“queues” if you’re British) last summer at Dover as Brits race to vacation in the France they love to hate. Torn between campaigning for the Tory leadership and her role as a diplomat, then-Foreign Secretary Liz Truss decided to blame it all on the French and their post-Brexit border controls. In a mind-warping leap of logic, Jacob Rees-Mogg, the MP representing the 18th century and Truss’s most ardent supporter, accused French authorities of “sabotaging British holidaymakers’ plans.” Which leads us to wonder, were these people not paying attention with former Prime Minister Theresa May said, “Leave means leave”?

• Speaking of those vile Frogs, Brits relocating to France now have to endure a four-day, mandatory course on “how to be French.” Just when we thought it couldn’t get any worse ….

• We’d be remiss if we didn’t take a moment to savor the schadenfreude. There are so many crimes and misdemeanors associated with Boris from violations of his own pandemic rules to, shall we say, less than savory characters in his administration that one almost overlooks the role of Brexit in ending his three years of governing in the sober and dignified style of Larry, Moe and Curly.

From the Washington Post opinion piece that simply nails it:

Johnson’s greatest failing is liable to be what he hoped would be his glorious legacy: Brexit … the problem for Johnson is that Brexit is doing serious and lasting damage to the British economy.

The post by Stryker McGuire (good name!) works through the Brexit chain reaction crash: The United Kingdom never got those big post-Brexit trade agreements including with the United States. Because trade is down, so is Britain’s GDP and standard of living. Real wages are down. There are shortages. The pound sterling is down against the dollar. The National Health Service is hollowed out. “If there’s an economic silver lining to Brexit, researchers scouring the data have yet to find it,” McGuire writes.

• Life is always about fundamentals. Is post-Brexit life better? That’s easy to quantify, and the answer is a clear and resounding “No.” The progressive New Statesman has a brief report that shows the British economy is trailing far behind its European rivals.

Per capita income has fallen by 4 per cent in real terms since the second quarter of 2016, when the vote took place, compared with 15 per cent growth in the EU, according to figures from the Organisation for Economic Co-operation and Development.

That in and of itself should put the lie to Brexit, which promised wild economic growth for the UK once freed from EU regulations. Now, the Brexiteers are reframing and rationalizing that Brexit hasn’t been done properly. “It wasn’t just about the economy. It was about taking back control.” Well, the less economic clout you have, the less control ( whatever that means) matters to citizens who actually have to eat.

Even Boris couldn’t really come up with anything when asked to detail all the great things Brexit has wrought. Though Jacob Rees-Mogg, the MP representing the 18th century, pointed out that Brexit reduced the price of fish fingers (?) by two percent.

Well, there you go ….

• While Brexit has brought so much uncertainty, there is one little corner of the reactionary media you can always count on – the Daily Express, which has been predicting rapidly falling dominos of countries leaving the EU. The Express actually had a story based on an English guy who lives in Italy hearing from a friend who heard on a talk show how Italy would be the first to follow the United Kingdom out to freedom. No, wait, it would be Greece. No, not Greece, the Netherlands. Now, it’s France. “Emmanuel Macron facing worst nightmare as Brexit-hater may be forced into snap FREXIT vote” reads the latest headline. It quotes a “prominent Frexiteer” who is so prominent that only the Express has ever written about him. We see what you did, there. Wisely, the rest of Britain’s conservative press quietly pushed Brexit off their front pages and landing pages.

Hey, did you see Paulie was headlining Glastonbury!?

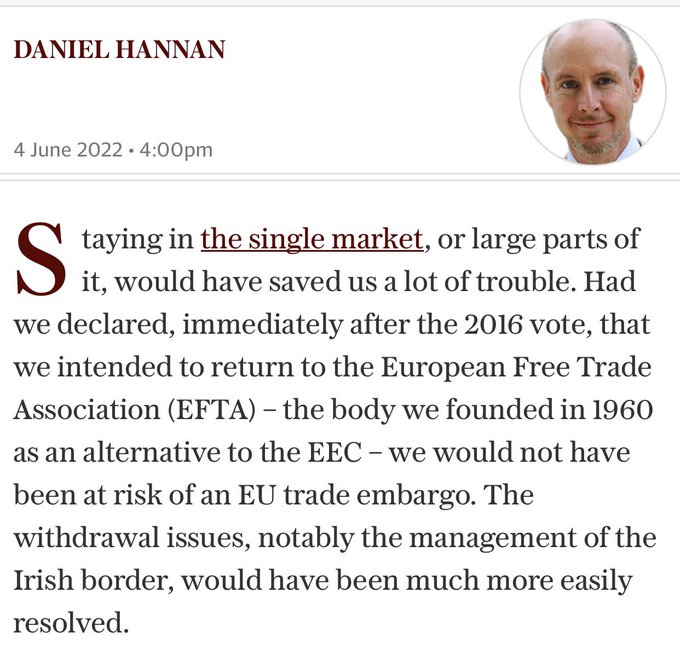

• Lord Hannan is in the news. No, you’ve never heard of him, but he’s a staunch Brexiteer who now has the nerve to admit the UK should have stayed in the single market. To make matters worse, another Tory – MP Tobias Ellwood –actually gave voice to the heresy that the UK might actually want to consider rejoining the single market, though not the EU, à la Switzerland.

• The historic legacy of Brexit might end up being be the reunification of Ireland. In May 2022 elections, the republican Sinn Féin — which advocates a united Ireland — emerged as the largest party in Northern Ireland for the first time in its history. At the same time, the Brits are trying to craft new legislation that would essentially say, “Oh, that agreement to have customs checks on the Northern Ireland/Republic border as part of Brexit? Yeah … nah, we’re not gonna’ do that.” If the pro-British Democratic Unionist Party loses power in Belfast, a united Ireland would end the debate once and for all and put the Emerald Isle completely in the EU. This is an immensely complicated issue that could get simplified with one election.

• Once in a while, there is an item in the news that highlights the fact that some good came out of Brexit. For example, Politico has a post asking if Brexit helped Britain help Ukraine faster than the stumbling European Union’s response. The answer is mixed. Yes, without the endless votes and committees, Britain is moving faster to transfer weapons and materiel to the Ukrainians, and to cut off Russian oil, than EU countries. But the anti-immigrant sentiments behind Brexit make it insanely difficult for caring British families to take in Ukrainians fleeing the fighting.

• To celebrate its glorious second year of freedom from EU tyranny, the Johnson Government published “the Benefits of Brexit” to general derision, even in the tabloids that had supported the leave campaign. The opening pages of the 108-page tome mentions closing borders, which has led to the ongoing labor shortage once EU citizens returned to the Balkans, and “retaining our iconic blue passports,” which the UK could have done as an EU member. In fact, Channel 4 News devoted an entire post to the absurdity of the claims, a post that ends with:

As part of a “Benefits of Brexit” report published today, the government highlighted four policies: reintroducing blue passports, using a crown symbol on pint glasses, establishing freeports, and reducing single use plastic bags. But two of these could have happened while the UK was a member of the EU – and two of them did.

iNews notes that one of the great benefits of Brexit is that “queues of lorries outside Dover are now so long you can see them from outer space.” Oh, and those new trade agreements with the US and other economies? Exactly two happened: one with Japan and one with Norway. Even the Times of London, a Brexit booster, is now wondering what happened to those benefits.

• So who has benefits from Brexit? Estonia. The NYTimes has a post about the thousands of UK-based companies that have created secondary legal registrations in the Baltic E.U. member country in order to keep doing business in the E.U. That includes a fair number who have physically relocated, according to the Times. More than 4,000 British firms have helped to increase Estonia’s tax revenues by 60 percent compared to 2020, according to Estonian Prime Minister Kaja Kallas.

• Brexit was supposed to make Britain Eurorein, cleansed of all the Romanians, Bulgarians and Poles. Alas, getting rid of the people with actual practical skills such as butchers and slaughterhouse workers so worthy Englishmen could have their jobs has not turned out well. Apparently, those worthy Englishmen wanted no part of working in animal blood up to their ankles. So the UK is creating a new short-stay visa for butchers and people to work in abattoirs.

• The Express, which defines English chauvinism, has investigative posts digging deep into the outrage over the pain Brexit has caused English retirees living in France and Spain and beseeching Boris Johnson to just do something. It seems that once the UK left the EU, British citizens in the EU became the targets of local authorities enforcing local laws. Which The Express defines as relentless persecution, forcing British expats to get, for example, Spanish license plates for their cars or Spanish health insurance. The situation in France is even more extreme. “Thousands of British expats left in ‘precarious situation’ by French residence rules” documents how those who didn’t bother to apply for long-term residence permits are now considered outlaws.

No!

• The latest labor shortages have been years in the making. For decades, the United Kingdom – as part of the European Union – has relied on low-paid workers from Poland, Bulgaria and Romania to take the jobs Brits won’t do. When Dispatches staffers were in England pre-Brexit, they found all the car washes were run by hard-working Polish entrepreneurs. Now, post-Brexit, a lot of those people have left and suddenly, there are posts on BBC, Bloomberg and other news and business websites about – get ready for it – a massive labor shortage, with more job openings in the hospitality business than at any time since record keeping began, perhaps 1.1 million.

“Is there a solution to the hospitality staff crisis?” asks a BBC headline. It turns out that Brits do not fancy 70-hour weeks for minimum wage … shocker.

The Guardian has a post, “Employers offer golden hellos of up to £10k amid worker shortage,” with the bonuses going to nurses willing to work the night shift in hospitals and care homes. So far, few takers ….