(Editor’s note: This is Pt. 2 of Netherlands-based entrepreneur Rachel Arts’ two-part series on options for replacing her United Kingdom-based bank after it closed her account due to Brexit. You can read Pt. 1 here.)

The customer experience trying to open an account, from another country, via post, is challenging to say the least and in stark contrast to the experience opening an internet-only bank account – which I had considered as a solution for my banking needs after my British bank closed my account.

Can the internet-only banks save the day?

The internet-only banks operate using a banking app, making the experience truly mobile. There seemed to be lots of options, but because I had particular requirements, I had to really drill down into the details of what each one offered. Overall, these digital banks are like a breath of fresh air with what they offer displayed clearly, and where I had questions, I was able to message and get answers within a couple of hours. In total I looked at five different internet-only banks that operate for EU customers.

These were:

• Monese

• Revolut

• Bunq

• Starling

• and N26

Monese, Revolut and Starling are based in London. Bunq is based in Amsterdam and N26 in Berlin.

Each has a different emphasis. For example, Bunq is aimed at British travellers in the EU, rather than those residing in an EU country. Starling launched EU accounts in 2019, but you first have to have opened a UK account, so I missed the boat on one. Revolut had no guarantee on funds, and Monese isn’t opening accounts for Netherlands-based customers at the moment.

I settled on opening an account with N26, although it only holds euros rather than pound Sterling, so it does not meet my main requirement. They do, however, have a great package for freelancers and the self-employed, so I will be keeping my eye on that.

Overall, however, the difference of dealing with an internet-only bank and a traditional one was startling. With N26 I had opened my account in minutes. Literally, all I did was take a picture of my passport and a photo of myself and within 20 minutes I was up and running.

My card arrived in the post a few days later.

The internet-only banks seem to be more responsive to what customers actually need and give more flexibility and reduced fees for those that want to bank across borders. I do wonder how the traditional banks are going to fare in the longer term if they cannot get their act together.

Banking in the Netherlands

Coming to the Netherlands and experiencing a different banking system has been interesting. When you only know one way of doing things, it takes a while to get used to a different way. I opened my accounts with ING, one of the country’s largest banks ranked by deposits.

The setup seemed similar to the UK. ING is a traditional bricks-and-mortar bank but with a banking app, which is easy to use. The Dutch seem to have a love affair with QR codes, and anything that requires security usually has a “scan from your phone” stage to log on via a personal computer. This isn’t just true for banking but also for accessing your Digi ID – which is the gateway for any dealings that come from central and local government, such as taxation, educational institutions and healthcare.

Sadly, my ING bank account does not let me purchase anything online that is outside the Dutch market as there is no VISA or MasterCard element for this. In the Netherlands they have their own system called iDEAL. This works fine, and to me it just appears as an extra secure interface between a customer’s bank and the third party they are paying. For all my international purchases, however, many of which are for my business, I have had to use my credit card as my ING card will not work for these.

I have, however, just been notified that my Nationwide credit card account will also be closing due to Brexit, hence the advantage in opening an account with N26.

What’s a “tikkie”?

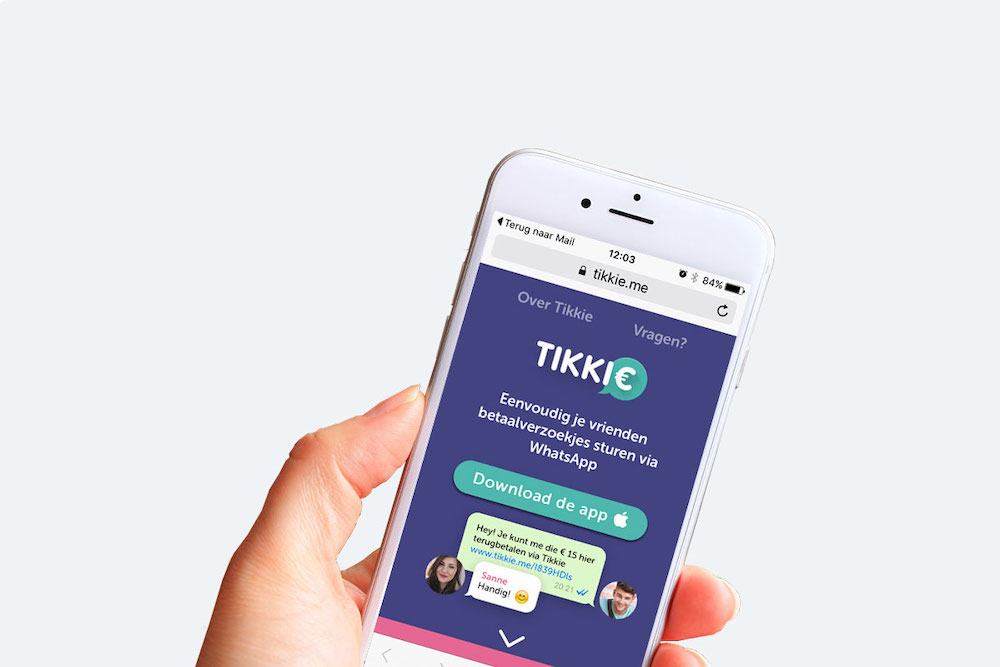

The Dutch have some handy features with their systems. In my Dutch language class, I was due a refund and the teacher asked me to send her a “tikkie.” I had to ask my husband what that was as I had no clue! Apparently, from your bank, you can send a request to someone in a text message or email for a specific amount of money. For them to pay, they just need to click on the link. No more dishing out your sort code and account number and people having to “set you up” as a new payee.

A few days after this I encountered another tikkie – the small business that made my curtains sent me an invoice with an accompanying email link I could click through to make the payment easily. This can be used in the same way to split a bill easily between friends – something that I’ve seen some of the internet banks offer.

I do like this system as a way of collecting payments as a business and am keen to use it for my customers, although I’m not sure how easy it will be to have a system that works for both UK and Dutch clients.

About the author:

Rachel Arts originally is from the UK but relocated to Eindhoven in 2019 with her husband. Rachel is an entrepreneur. Her business, Talentstorm, draws on her 20-plus years in corporate learning to help develop individuals and organisations.

She loves to write about all things related to personal development, self-directed learning and modern learning practices. To learn more more, check out the Talentstorm website here or follow her people-development blog here for regular tips to achieve work and career goals.