If you’re an American corporate nomad or aspiring expat who’s never lived in Europe, get ready for a shock.

Outside of New York, Boston, Washington, D.C., Seattle, Portland and San Francisco, wealthy Americans in the majority of cities prefer manicured enclaves in suburbs surrounding downtowns. In the United Kingdom and Europe, the wealthiest tend to live in city centers in order to be close to financial districts, transportation, restaurants, theaters and parks. So, renting a nice flat in the middle of Paris, Berlin, Rome, Copenhagen, Zurich, Amsterdam and especially London is going to be a very, very expensive proposition. (All those romantic notions you might have about Hemingway in “A Movable Feast,” living for nothing above that sawmill in Paris … just remember, Hemingway made his living making stuff up.)

Economists use many data points when trying to assess how hot, or cold, the global economy is. Right now, we all know oil prices worldwide are at an all-time low because of a combination of over-production and slack demand. A better indicator of how strong Europe’s economies are might be rents. Which are too damn high, as the song says, especially in the United Kingdom. Which is where we’re going to start.

Rents in Britain are rising because of an influx of people from the provinces, former colonies, continental Europe, Asia and the Middle East, all drawn by a booming economy. So far, the housing supply is lagging far behind demand. And you know what that means … the rent is too damn high. In London, a large percentage of residents spend more than half their wages on rent, according to the World Economic Forum. (London is only No. 5 on the WEF’s Top 10 list of the world’s most expensive cities to rent behind Luanda, Angola, San Francisco, New York City and Hamilton, Bermuda.)

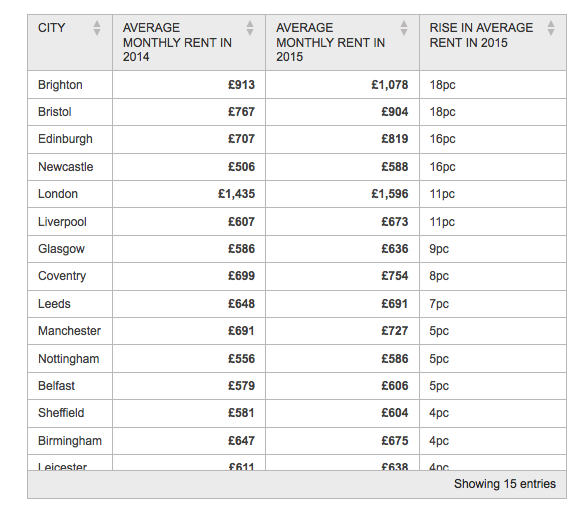

Accounting/biz consultant giant PricewaterhouseCoopers predicts owner-occupied housing in London will fall from a peak of about 70 percent before the financial crisis to around 60 percent of households by 2025. So that’s a lot of pressure on rents. The Telegraph in London has an interactive post, “Mapped: where rents are rising fastest (and it’s not London)” that showed Bristol, Brighton, Liverpool, Newcastle and Edinburgh all had double-digit average rent increases during 2015. And here’s a bit of a shocker: Brighton’s average monthly rent –1,078 pounds – isn’t that far behind London’s 1,596 pounds. Okay, London rent is 50 percent more expensive, but increasing at only 11 percent per year as opposed to Brighton’s 18 percent.

Accounting/biz consultant giant PricewaterhouseCoopers predicts owner-occupied housing in London will fall from a peak of about 70 percent before the financial crisis to around 60 percent of households by 2025. So that’s a lot of pressure on rents. The Telegraph in London has an interactive post, “Mapped: where rents are rising fastest (and it’s not London)” that showed Bristol, Brighton, Liverpool, Newcastle and Edinburgh all had double-digit average rent increases during 2015. And here’s a bit of a shocker: Brighton’s average monthly rent –1,078 pounds – isn’t that far behind London’s 1,596 pounds. Okay, London rent is 50 percent more expensive, but increasing at only 11 percent per year as opposed to Brighton’s 18 percent.

Britain – especially London – has the most painful rent rates in Europe, with a disproportionate impact on younger people.

A July 2015 report by PricewaterhouseCoopers predicts 25-percentof all UK households will be renting privately by 2025 (7.2 million households), and that more than half aged 20 to 39. As house prices have risen much faster than earnings, (the average house in the U.K. sells for 200,000 pounds) the number of households renting privately has more than doubled since 2001. (For those living outside England, “renting privately” means rented at market rates from multi-family real estate developers or private owners as opposed to subsidized “council housing” built by municipalities.)

But a recent PropertyWire.com post put a positive spin on the ever-rising rates. That the majority of tenants can afford higher rents “is certainly good news, and should be seen as a positive indicator as we enter 2016,” Adrian Gill, director of estate agents Reeds Rains and Your Move, is quoted as saying. But Gill conceded that over the longer term, higher rents raise “a serious challenge for the future affordability of housing” in the U.K. A PropertyWire post this week notes that prices in the “Home Counties” – the counties surrounding London proper – actually dropped. But the post also notes increasing pressure on rents as more people come to the London area from other parks of the U.K., Europe and the world at large.

So, how does this affect real people? As we were researching this post, we found a Times Higher Education article that illustrates how the insane wealth of the Global One Percent makes deciding to become a teacher, for example, means you’re in for a precarious life. “Priced out: housing cost headaches for universities and staff” identifies not London, but Oxford just west of London, as UK’s most unaffordable city. That is, the gulf between house prices and rents and average incomes there is even wider than in London. The post quotes Bob Price, the city’s Labour council leader, saying “if things carry on…we are very much in danger of not having Oxford in the top four or five universities in the world.”

If Oxford has to compete for top international talent, used to living in city centers, they’ll find they’re completely priced out, according to the post:

But even if offered a salary of, say, £100,000 (the average professorial salary at the University of Oxford is £67,224), they find that the cheapest house they would settle for costs 10 times this.

Meanwhile, in Central London, the big trend is luxury apartments (apartment that you buy, in the New York tradition) that include hotel-style amenities.

As the global economy revives from Great Recession lows, rents are rising in cities that had previously been affordable … and had benefited from the affordability by attracting talent. Private rentals in Berlin rose so fast in 2015 that we ditched plans to base Dispatchers Europe there, choosing instead the far more affordable – and just as talent-rich – Eindhoven. (Okay, Eindhoven is a small provincial town, and Berlin is one of the coolest cities in the world. But you go with what you can afford, and Eindhoven does not lack for talent and other desirable amenities.)

As a result, Berlin officials started linking income to rents in public housing effective Jan. 1, according to The Atlantic Magazine. A new law states that low-income residents living in state-owned housing will pay no more than a one-third of their gross income in rent. For tenants in a few buildings with especially high energy costs, that ceiling will be dropped to 25 percent of gross income, according to the Atlantic post, “Berlin: People Shouldn’t Have to Spend More Than a Third of Their Income on Rent.” The federal government also plans to build 30,000 new public-housing units within the next 10 years.

Still, when we started using ExpatRentals to shop for apartments in Berlin in January 2015, a 130 m2 apartment in a nice area such as Prenzlauer Strasse was going for maybe 2,000 euros per month. By the time we got to Berlin in July, there was nothing on the market large enough for our family for less than 3,000 euros. We also looked at Amsterdam, but quickly realized it’s even more expensive than Berlin. So expensive global commercial real estate firm Cushman & Wakefield sees a whole new market in cities such as Amsterdam and Rotterdam … the 50m2 apartment that rents for 900 euros per month! (Caution … the link is to a .pdf 2015 residential market report that’s quite large.)

From the report:

While we already see that premises of 40 – 50 sq.m are occupied, it is nowadays more financially driven in order to retain occupancy costs at an acceptable level than it will be in the future. Indeed, living nearby facilities in vibrant, urban, areas will be more important than the size of the premise. As a result, new developments and transformational projects in urban areas have a significant potential to focus on relatively small premises.”

Translated: “If you’re coming to the big city in Holland, get ready to pay out the wazoo for a tiny little apartment. But, you’ll be living in a really groovy part of town.”

The final irony: The British media are reporting a big London-based institutional investor is teaming up with a Dutch pension fund manager to build 3,000 apartments across the U.K. Legal General, the British concern, and Utrecht-based PGGM will collaborate on 650 units to start including in London. But the Guardian notes only about half of the 250,000 new homes needed every year to relieve pressure on the rental market are being built!

Finally, here’s a Dispatches Injection of Reality: You might be reading in the U.S. media about Europe being in decline. The reality is, more of Europe is more affluent than it’s ever been in history. So, we’re working now on a post about the cities that have both an affordable cost of living AND a high concentration of talent … cities we believe will be future startup and innovation centers.

Co-CEO of Dispatches Europe. A former military reporter, I'm a serial expat who has lived in France, Turkey, Germany and the Netherlands.