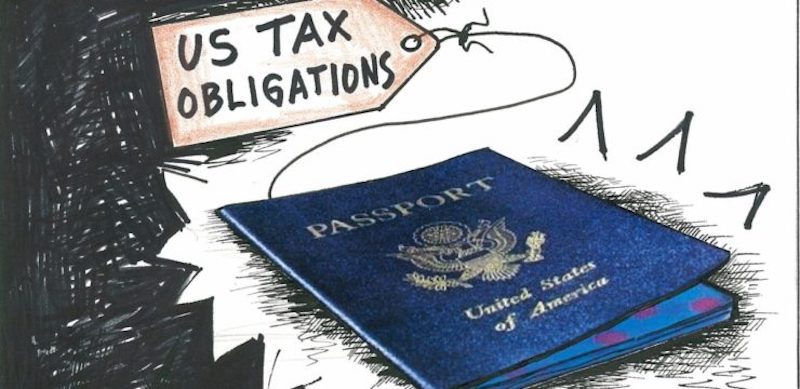

American expats could find themselves with a one-way ticket back home – and no passport – if they ignore outstanding tax debts of more than $52,000. Which sounds like a lot of money. But if you stop filing income tax returns, the interest and penalties can add up quickly, especially if you’re a high net worth individual.

Infamously, the United States of America is one of the few countries along with North Korea, Eritrea and Libya that makes their expats file income tax returns when they don’t even live in the county. As you can imagine, a lot of said expats who never plan to return don’t bother to file after awhile.

For years, there’s been internal wrangling over whether the US should exempt U.S. passport holders living outside the territorial United States, or crack down on them. In his 2016 campaign, President Trump hinted that he might be willing to wave the rules. Alas, it didn’t happen and last year, the IRS decided it would start revoking the passports of Americans with big outstanding tax bills.

Since May, the IRS has sent notifications to about 400,000 people warning them they’ve been identified as falling into the “substantial tax debt” category, owing more than that $52,000 threshold, according to Bloomberg Tax. And that the price of this negligence could be their passports.

The IRS has the authority to order the State Department to revoke the passports of taxpayers with “seriously delinquent tax debt,” according to IRS documents. And to be clear, this is any delinquent tax debt, not only unpaid taxes on foreign income or assets overseas.

One important point is that in a worst-case scenario and your passport gets revoked while you’re outside of the country, the State Department can issue you a “limited validity passport,” good only long enough to get you on a direct flight back to the US.

The whole foreign tax compliance issue is complicated by the fact there are so many “accidental Americans” … people born in the US to foreign parents who thought it was a good idea to get them an American passport. Then boom! … they get a huge tax bill out of the blue even if they’ve never actually lived in America.

They’re included in the total number of American expats, which ranges from 8 million to 10 million people depending on whose numbers you use.

The Bloomberg post points out that many, many “Americans” with foreign assets and bank accounts have no idea they’re facing the loss of their passports because the IRS does a terrible job of contacting people overseas. And ironically, it might not be a bad thing because intentionally surrendering your American passport will cost you about $2,350.

(We’re guessing that many, if not most, of expats affected by this will have another passport.)

That said, if you’re ‘murican born and bred living overseas or traveling there on business, there are lots of “ifs, ands and buts” including a skip if you’re in foreclosure, bankrupcy or the IRS determines your debt isn’t collectible due to “hardship.”

If you need your U.S. passport to keep your job, you either have to pay up or – if you can’t pay all at once – negotiate an “alternative payment arrangement” to get it back. What’s not clear is how long it takes for the IRS to notify State before all this happens.

So there are a substantial number of people who going to be spending a lot of finding out everything they never wanted to know about the US tax code.

Co-CEO of Dispatches Europe. A former military reporter, I'm a serial expat who has lived in France, Turkey, Germany and the Netherlands.