(Editor’s note: This edition of the Eindhoven Business Briefing is part of our Tech Tuesdays series. Dispatches covers tech because so many of our highly skilled internationals are engineers, web developers and entrepreneurs.)

We’re dedicating this Eindhoven Business Briefing to the ups and downs of the startup world. It’s a world we know well, and where we see the Netherlands struggling despite having the top semiconductor companies, top universities and top talent at every level.

We see several issues holding back Europe, and the Netherlands and Eindhoven in particular:

• lack of early-stage risk capital. Our ecosystem has founders willing to risk everything and investors unwilling to risk anything. That’s going to come back to haunt the Netherlands as more startups get funded in the United States. But this is a Europe-wide phenomenon. In its new State of European Tech Report, Atomico – the VC fund created by Skype founder Niklas Zennström – projects investment in European tech startups will decline to $51 billion this year from $83 billion in 2022.

• a holiday-to-holiday work ethic, but we’ve finally come to terms with the fact this will never change. And ASML proves that maybe you don’t have to work 48 hours per day to rule the world.

• a national Dutch startup ecosystem led by a prince. Why? An inherited title and wealth are the opposite of what lean and hungry startups are about. This is part of a larger cultural blind spot. Where we work, the offices are named after famous American tech pioneer such as Gordon Moore, not European tech innovators, of which there are many.

• too many engineers and not enough management talent.

• universities demanding too much of, and delivering too little to, startup teams.

To that point, Innovation Origins has a great post about how university policies are stifling innovation in the Netherlands compared even to other European countries, much less the United States.

Aafke Eppinga reports that while engineering schools in the Netherlands are higher rated than those in other European countries, including Germany, the spin outs from Dutch unis struggle. The reason, Eppinga writes, is that Dutch universities own any IP developed at the school, and that gives them an automatic equity stake in a startup trying to advance that technology.

“Once educational institutions have a ‘voting equity stake’ in a startup, this can stunt the company’s growth and deter future investors,” she writes. Moreover, the percentage of equity they take is far more than in the United States. That’s a real turnoff for any early stage investors and for the founders themselves, who might end up with only a tiny slice of the company.

She quotes former Google employee and Cradle CEO Stef van Grieken as saying that in the Netherlands, most startups “are dead before they get out the door at all, because the slice of the pie that goes to universities is too big to attract the highest quality investors.”

At our Tier1 Tech Talent subsidiary, we’ve seen so many cap tables distorted by the unis, government subsidies/pandemic loans and huge equity pieces awarded to angel investors for criminally low valuations.

See the Seal the Deal segment below for why you must have a financial person on your team.

Deep Tech Connect

HighTechXL has opened up registration for Deep Tech Connect: A Deep Tech Innovation Forum, presented by Silicon Valley-based Extreme Tech Challenge and HighTechXL. This is the event that will feature ASML CEO Peter Wennink, who’s built the photolithography company into the most valuable tech company in Europe, ranked by capitalization.

With this lineup of speakers, panelists and select startups pitching, this will sell out FAST! And when we say “sell out,” it’s actually free, but seats are limited and you can get yours here.

Deep Tech Connect will be a full-day event June 28th at The Conference Center on High Tech Campus Eindhoven.

Keynote speakers and panelists include:

• Peter Wennink, President & CEO ASML

• Nicolas Autret, Partner, Walden Catalyst Ventures

• Jean-Francois Bobier, Partner & Director, Boston Consulting Group (BCG)

• Constantijn Van Oranje-Nassau, Envoy, Techleapnl

• Andy Lurling, Founding Partner, LUMO Labs

• Riemer Smink, Managing Partner, FORWARD.one

• Marcel van der Heijden, Partner, Fortino Capital

HighTechXL CEO John Bell will moderate the “The State of European Deep Tech” panel discussion, and Victoria Yuan Slivkoff, CEO of Extreme Tech Challenge, the world’s largest global platform showcasing purpose-driven startups, will moderate the investor panel discussion “The Landscaping of the GenerativeAI Space.”

Deep Tech Connect is jam-packed with speakers and investor breakout sessions, but it’s also a deep-tech startup showcase. HighTechXL deep-tech ventures will pitch to the crowd in the morning session and other impact startups will pitch in the afternoon.

Let’s put it this way: In Eindhoven, there’s never been a deep-tech forum quite like this one before.

Be there or be square.

(Photo by Terry Boyd for Dispatches Europe)

Seal the Deal

This was my lede for HighTechXL’s recent Seal the Deal event on 1 June at Philips’ Building 34 on High Tech Campus Eindhoven:

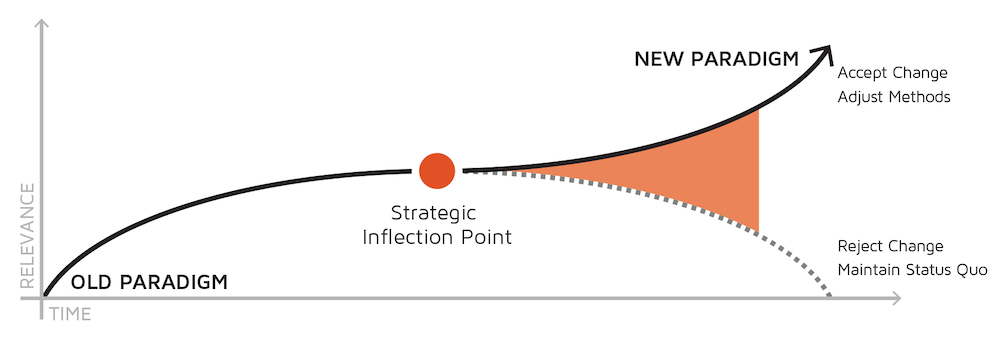

Okay, say you’re an engineer with a startup developing the coolest deep-tech product. The science is essential. But you’re going to need investment capital and lots of it. Enter the dark art of deal making. Which is very much an art, not science.

HighTechXL can help with that.

In the past seven years, what I’ve seen time after time were great teams of engineers and physicists who knew next to nothing about finance, especially early stage risk capital. That’s a problem. So, I wasn’t going to miss Seal the Deal. And anyway, I seriously needed a refresher on the term sheet minutiae, which I will admit always confounds me. (Which is why we always have an M&A attorney standing by.)

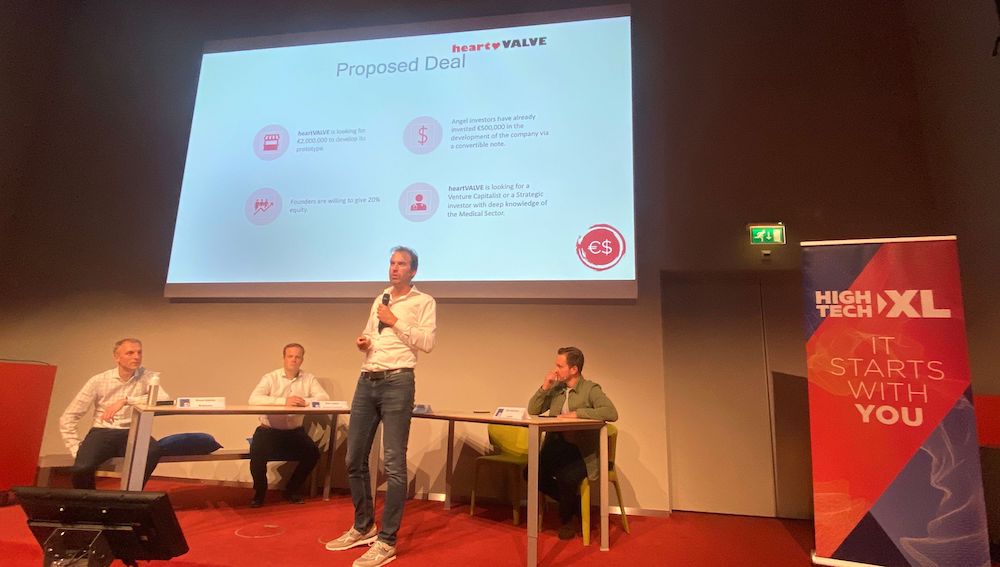

Seal the Deal brought together a real venture capitalist (Bart Lugard, DeepTechXL), a real M&A attorney (Bart Hesemans, Blatter Legal), a real dealmaker (Broos Bakens, entre.ventures) and HighTechXL Chief Growth Officer Boudewijn Docter playing a role he knows well to create a whole term sheet process that can lead to investment.

In the presentation, Boudewijn played the founder of a fictional startup HeartValve in negotiation with Bart Lugard for a Series A investment round up to 10 million euros. While the 90-minute negotiation was civil, it was fraught with issues that were not easily resolved. Just like in the real world.

Playing the founder, Boudewijn, with guidance from Bart Hesemans, did what he’s done in the past as the founder of EFFECT Photonics … he asked a lot of questions when he didn’t understand some of the more arcane terms or agree with what seemed to him egregious demands from Bart the VC.

The presentation included:

• the valuation … how the VC and the founders agree on the abstract value of a company that has no revenue

• liquidation preferences, or who gets what if the company is sold or dissolved

• antidilution, the protection for investors should the startup have to raise more money at a lower valuation

• drag along and tag along, the rights VCs have when it comes to selling the company or to bringing in new investors

• good leavers, bad leavers and early leavers, which determines whether founders leaving the startup keep or lose their shares

One major point of contention was whether VCs should impose milestones, with the panel agreeing that for the most part, no startup in the history of the world has ever reached them.

One item Boudewijn took issue with as the founder was the founder vesting and lockup clause, rewarding the team by gradually returning to them the equity they had at the beginning as they achieve milestones.

“This is a very strange one for us,” Boudewijn said. “Now it seems I have to earn back my company. This feels emotional.” But Bart the VC assured him the clause was necessary to make sure critical personnel continued with the startup.

In the end, both sides – the VC and the founders – gave a little bit and reached a deal, a realistic outcome. Of course, not everything can be neatly quantified, and emotions and personality come into play. Which was just fine with our VC.

“The whole discussion is a psychology test, not just about deal details,” Bart said.

My opinion – accelerators and venture builders need to spend more time on these sorts of exercises. But, if possible, every team should include someone with an innate ability to bargain and who is comfortable with the arcane terms and convoluted concepts of risk capital. In the long run, VCs are not your friends. But a drama-free working relationship will benefit everyone.

– Terry Boyd