(Editor’s note: This installment of the Eindhoven Business Briefing is part of our Tech Tuesday series. Dispatches Europe tracks the tech scene – startups, scale-ups and mature companies – in our headquarters city of Eindhoven because so many of our highly skilled internationals are engineers, physicists or developers.)

Okay, kids, pop quiz … what’s the best innovation model?

You could be forgiven if you think there’s only one, the American-style startup: Two guys in a Los Gatos garage or a Harvard dorm inventing the future. American startup hagiography is replete with teams who started with two founders. Page and Brin. Hewlett and Packard. Jobs and Wozniak. But it’s also a model designed to fail fast, and more than 90 percent of American startups do fail, with founders moving on to new projects.

There’s another model that happens to be incredibly successful and the reason why Eindhoven is the most important deep-tech center in Europe. In fact, let’s call it the Eindhoven Model.

For decades, Philips has spun out some of the world’s most successful companies, including ASML and NXP. Yet, even our HQ city of Eindhoven increasingly is buying into the startup model. The problem is, the tendency in this startup ecosystem is to confuse declaring victory for actual success.

Hence, the new campaign by Brainport, the economic development org, to celebrate the survival rate of startups. Brainport execs claim more than 75 percent of the startups given Brainport’s Gerard & Anton Awards since the award started back in 2016 are still going. So Innovation Origins and Strategy Unit B.V. researched factors scale-ups in Brainport.

That research involved asking the 70 Gerard and Anton winners why they’re so successful compared to Dutch startups as a whole. The responses are grouped into pretty esoteric categories, including “cluster dimension” and “agglomeration dimension.” (Please don’t ask us to explain this bureaucrat-speak.)

Our first thought was, “Define ‘successful.’ ” We helpfully pointed out on LinkedIn that a.) Eindhoven, unlike Amsterdam, hasn’t produced a Unicorn in decades, and b.) VCs who invest don’t care about cluster dimension or agglomeration dimension. They care about whether the startup has a product everyone on earth will pay for and whether the team has the talent and grit to take that product to market.

Innovation Origins co-founder Bart Brouwers and I got into a bit of a back-and-forth after I pointed out how the total number of Eindhoven Unicorns during the past 20 years is easy to calculate. Zero. Maybe one near-Unicorn: Sendcloud. By comparison, startups in The Valley have a 90-percent failure rate the first year, but the market capitalization of the survivors coming out of there during the past 20 years is about $10 trillion.

Bart countered that Gerard & Anton award winners Sapiens, Liquavista and Civolution “would surely be in that (Unicorn) league, if not acquired before reaching that status. I’m not sure about Studyportals, but that might be another one.”

This is where our positions intersected. I agreed, noting that Sapiens, Liquavista and Civolution would surely be in that league – but they were never startups. They were spinoffs from Philips. “I think that’s far the better innovation model for Eindhoven.”

That model is teams of serious engineers form inside Philips, Royal Dutch Shell or one of the big tech companies around a new deep-tech technology. The parent organization funds their work until executives decide it doesn’t match the core competency, at which time the teams leave the nest and fly on their own.

That’s how ASML, NXP, Sustonable and a dozen other deep-tech companies got their starts.

The advantages of the Eindhoven Model include teams of men and women who’ve proven they can work together. They’ve got technology developed and perfected inside a tech giant. And they have initial funding, with, say, Philips shareholders retaining an equity stake in the spinoff’s success. And of course, there are other companies and research centers such as imec and TNO and Dutch universities that produce tech and teams.

I’ve seen this work in the United States in various industries, including tech and telecom. And little-known fact … Sergey Brin and Larry Page get all the pub, but when Google went public, Stanford University actually owned the PageRank IP and got a check for $336 million.

The spinoff model works even better in Eindhoven. If you invested $50,000 in ASML circa 2011, you’d have more than $1 million now, according to the Motley Fool investment website.

In my mind, the Eindhoven Model minimizes risk while maximizing returns for investors, not an easy feat. Should it replace the American model? Of course not. But in advanced, yet risk-adverse, societies such as the Netherlands, spinoffs are a deep-tech innovation model that can produce more success faster and with far less risk.

– Terry Boyd

ASML’s giant cash register just keeps ringing up profits

As China returns to a hardline Communist dictatorship under Xi Jinping, ASML and other Eindhoven-based tech companies are caught in the middle of a tech Cold War. With Chinese officials threatening to invade Taiwan, home to TSMC, the world’s largest chipmaker, the Americans do not want the Chinese to have advanced tools that could make chips for military uses. So, the United States is imposing more and more restrictions on semiconductor makers doing business with China’s semiconductor industry.

Bloomberg has a post, “Europe’s Most Valuable Tech Company Tries to Avoid the Chip War,” looking at the fallout for the curbs for the company that makes the only advanced extreme ultraviolet photolithography “tools.” These room-size machines go for $200 million a pop and are essential to making advanced computer chips.

Top executives state that some equipment blocked from some sectors of the Chinese semiconductor industry could have a material effect on ASML, no question. But having the most essential machine tools for the chip industry guarantees ASML “consistent demand, zero competition, and pricing power for its products,” notes the Motley Fool investors newsletter.

That’s resulted in ASML reporting another crazy good quarter – 1.7 billion euros in net income on top-line revenue of 5.8 billion euros and a net gross margin of about 52 percent, on par with Microsoft and Apple.

TU/e plans to double its enrollment

Speaking of ASML, it’s projected to add 15,000 employees in the coming years. To meet the demand for engineers and physicists, our sources are telling us Technical University of Eindhoven wants to double its enrollment in eight years. Those officials are pitching the big tech companies to help fund new housing because no one wins if the most promising students have to return home because they can’t find housing.

Axelera AI raises $27 million round

We knew this was coming, but couldn’t post it until it was official. Eindhoven’s fastest-growing startup, Axelera AI, closed a $27 million Series A investment round. The new capital will support Axelera AI’s launch and mass production of its first-generation AI acceleration platform – software and hardware – along with an expansion of its team.

This is a startup that we didn’t exist two years ago. In just 14 months Axelera has hired more than 80 team members, distributed between its headquarters at High Tech Campus Eindhoven, R&D offices in Leuven, Belgium and Zurich, Milan and Bristol. This is the ultimate collection of highly skilled internationals, with the team representing 11 European countries, and with experience at Intel, Qualcomm, IBM, and imec. The company plans to expand to the United States and Taiwan this year.

Innovation Industries, an independent VC with funding from RaboBank and institutional investors, led the $27 million round.

We’ll have an interview with co-founder and CEO Fabrizio del Maffeo.

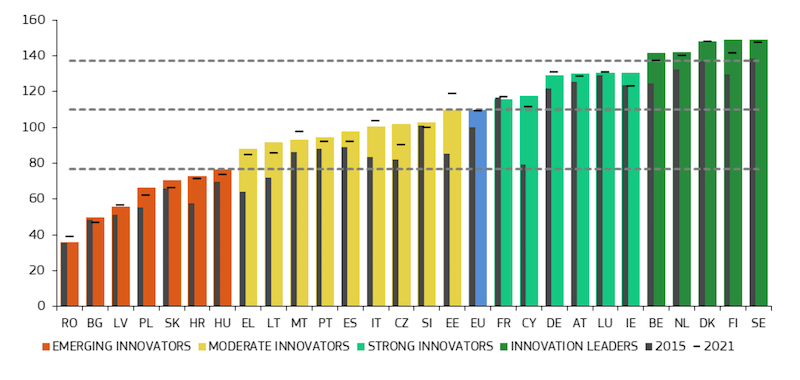

Netherlands No. 4 on EU’s Top 5 most innovative list

The Swiss-based NGO World Economic Forum, which sponsors the Davos G7 gathering, has just released its list of the Top 5 Most Innovative Economies and no surprise, the Netherlands is on it. But exactly what this means is unclear, at least to us. The snippet with the Netherlands’ “relative strengths” mentions public-private co-publications (we’re thinking they mean research), foreign doctorate students, lifelong learning, people with “above basic overall digital skills,” and ICT specialists.

Sweden is No. 1, followed by Finland, Denmark, the Netherlands and Belgium. Weirdly, Germany trails Austria and Luxembourg. A new world order?

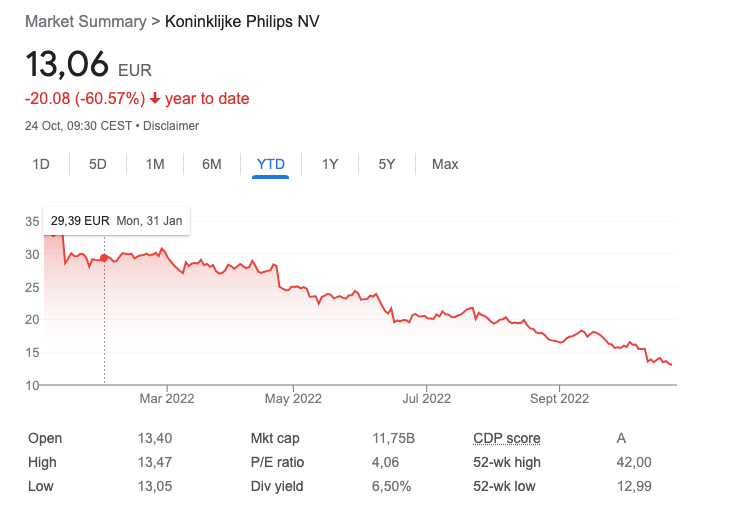

Philips struggling

Unlike ASML, parent company Philips seems to be in a downward spiral, with the share price dropping to about 13 euros on 25 October from a 2022 high of 33 euros back in January. Philips has reported five straight negative revenue and sales quarters.

On Monday, 24 October, Philips executives announced they’ll cut 4,000 jobs worldwide out of 79,000, including 400 forced redundancies in the Netherlands, according to NOS.

For Q3, Philips reported a loss of 1.3 billion euros. The red ink mostly came from a settlement in the US regarding a faulty sleep apnea device.