(Editor’s note: Dispatches Europe tracks the tech scene and capital trends in Europe because so many of our highly skilled internationals are engineers, physicists and developers who aspire to be part of the new new thing. This post on American investors in Europe is part of our Tuesday Tech series.)

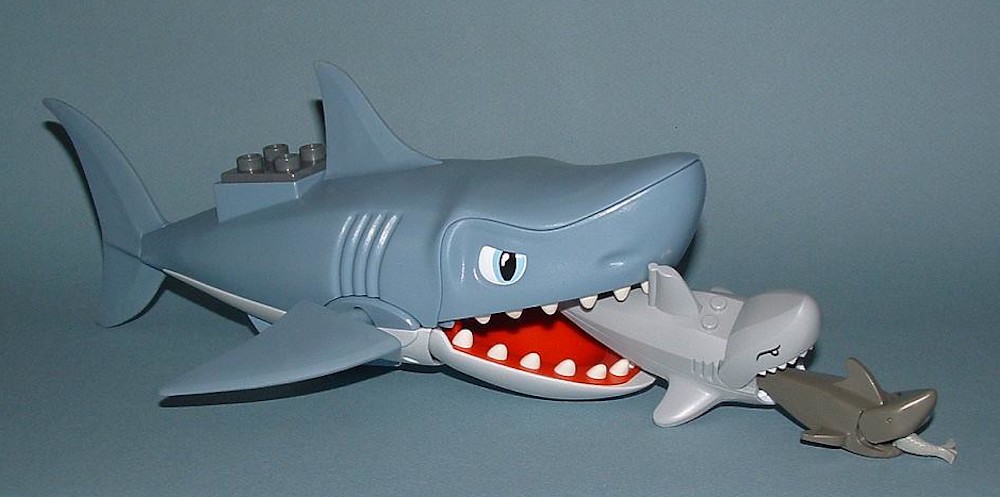

Until just the past two or three years, the maps on the walls of the venture capital firms lining Sand Hill Road showed dragons circling the Atlantic with the words, Hic Sunt Dracones (here be dragons). Now, the dragons are gone and we’re entering the Age of the Sharks – American investors who can’t get sufficient deal flow in the United States suddenly discovering the terra incognita of Europe.

To be fair, earlier capitalist explorers met with disaster in Europe. But there’s so much cash now in the U.S. chasing too few deals that American venture capitalists are overcoming their aversion to geographical separation and standing up operations across Europe, chiefly in London.

Conveniently, one of the biggest recent acquisitions is literally in Dispatches’ backyard, in our headquarters city of Eindhoven, Netherlands, where Oaktree Capital is in a pending deal to acquire High Tech Campus Eindhoven. HTCE would be a huge get for American investors, Europe’s premiere open research campus and home to notable tech giants including chipmaker NXP and Philips Research.

Oaktree Capital in deal with High Tech Campus Eindhoven

This has been presented to Dutch media as Los Angeles-based Oaktree Capital Management, an alternative assets manager with $150 billion under management, “buying the campus” from Dutch investor Marcel Boekhoorn for 1.1 billion euros. Of course, that’s not how Oaktree works and the deal hasn’t even closed. Which Oaktree media people in Amsterdam and LA pointed out when we called for comment, citing American securities law requiring “quiet periods” before deals are final. Also lost on the Dutch media outlets is that Oaktree’s legendary founder Howard Marks taking a position on High Tech Campus Eindhoven is a significant part of a dramatic trend of mega-deal makers such as Blackstone and BlackRock scouring Europe for underpriced assets.

But Marks is no Warren Buffett. Instead of a buy-and-hold value investor, Marks made his fortune in figuring out which distressed real estate and assets have real underlying value and manageable risk, then turning them around and reselling them. Oaktree is by far the largest distressed securities investor in the world.

What exactly is Oaktree? Marks and co-founder Bruce Karsh have created a global financial powerhouse that’s excels at balancing risk and return. Oaktree is partly a private bank, focused on lending to struggling companies and financing deals, including mezzanine lending. It’s also partly a private equity firm, taking stakes in mature companies, restructuring the debt and management, then selling them.

Since it was founded in 1995, Oaktree returns have been so consistent that almost every American institutional investor – insurance companies, pension funds and corporations and endowments – has invested in various Oaktree funds, seeking a higher yield through alternative investment classes such as real estate, yet with manageable risk.

In March, Oaktree closed its eighth Real Estate Opportunities Fund, raising $4.7 billion, capital to be invested in distressed real estate. And that’s where High Tech Campus likely comes in, falling under Oaktree’s “opportunistic strategies” approach.

Does Oaktree pay top dollar for premium real estate? No. Profitable commercial real estate typically only changes hands when investors have exhausted their tax advantages, investment funds mature and fund managers return capital to limited partners or investors want to recapitalize to take advantage of more profitable deals in a changing market. Boekhoorn reportedly paid Philips, which developed High Tech Campus, 425 million euros in 2012 for the campus. What we don’t know is how leveraged that deal was, the terms for that capital or the lease terms for tenants.

As we noted, HTCE is home to one of the largest semiconductor companies in the world, NXP, and 235 other companies. The number of tenants has grown dramatically since Boekhoorn’s acquisition. Did Oaktree buy it for the gross leasable space and the rent flow? Unlikely. Did they write a check, giving Boekhoorn and his investors the equivalent of a 7-percent annualized return at a time when you pay the bank to store your money? Again, very unlikely this is a cash deal. American capital management firms are all about buying low and selling high. That’s how they keep attracting new investors.

Our guess – and it’s only a guess because Oaktree execs aren’t talking – is that this is a debt-for-equity swap. That means campus investors will see their debt position paid down, then deducted as a discount on the final transaction value of their equity stake when Oaktree exits the deal. Or Oaktree simply bought their debt and equity at a discount.

Though Boekhoorn’s investment vehicle, Ramphastos, is private, Oaktree is publicly traded on the New York Stock Exchange under the symbol Oak-B. And publicly traded companies have to reveal some, though not all, transaction details under American securities law. Whatever the deal details, American investors most likely will be a good thing for Eindhoven. Because the sugar likely is in restructuring the campus debt and positioning HTCE to be acquired, that typically means bolstering management and injecting fresh capital into operations and even acquiring land for new buildings for a much bigger pie. Boekhoorn & Co. will likely just own a smaller – though more valuable – piece of that pie.

One of the most accessible financiers in the world, you can catch Marks on CNBC or pretty much any financial channel talking in amazing detail about his strategy and how he sees his deal flow.

American investors will win over their European rivals because they’re richer and more aggressive and relentless. And they have a far greater tolerance for risk. That will have a profound effect on capitalism here from Europe’s startup scene suddenly booming to American sharks pressuring European executives to curtail the crazy amount of vacation time they take.

That canny observer of capitalism Karl Marx said it best: Capitalism remakes the world in its own image. Amazingly, you can actually watch this happening here in real time.

Billions

Speaking of alternative investments, American institutional Investors appear to be all in on the European private credit strategy. Earlier this year, the California Public Employees’ Retirement System disclosed two commitments of about $1 billion each to credit funds to invest in Europe. The $478 billion Sacramento-based pension plan committed $1.1 billion to Ares Capital Europe V and $1 billion to Blackstone Real Estate Debt Strategies IV, a global real estate direct lending fund, according to Pensions & Investments.

Much of this capital is flowing to private lending/direct lending to corporations trying to stave off hostile takeover acquisitions that, for whatever reason, can’t get favorable terms from conventional lenders such as banks.

Goldman digs for Dutch gold

Wall Street darling Goldman Sachs, that great vampire squid sucking humanity dry, is amping up its Europe activity, including acquiring a Dutch money manager NN Group NV for $1.9 billion.

Post-Brexit, Goldman has shifted billions of dollars of assets and most of its people from London into offices across the European Union, including Paris, Frankfurt, Milan and Madrid, according to Yahoo! Finance.

The Tiger roars

On the venture capital side:

• New York City-based Tiger Global is scaring the bejesus out of Europeans, showing up for every A round and B round across the continent. It just took part in a $75 million B round for xentral, a Berlin-based enterprise resource planner software company, according to TechCrunch.

• Peter Thiel’s Valar Ventures led a $263 million Series C investment in Bitpanda, a Vienna-based digital asset trading platform and Vienna’s first big-time unicorn at a valuation of 4 billion euros. Though edtech startup GoStudent is, after investment by NYC-based Coatue, also a unicorn, valued at just over 1 billion.