(Editor’s note: This is Pt. 3 of a three-part series on buying a home in Berlin. You can see Pt. 1 here. You can see Pt. 2 here.)

As soon as we settled in Berlin from Ukraine, worked here for a few years to get permanent residence, and saved some (not much) money, I started persuading my husband that it was time to think of that house.

Here’s what we learned on our journey to find a place of our own.

How much is the fish, take three: cost of money

Even though the “real” real estate prices in Berlin have supposedly been sinking in the past year, the mortgage rate has not.

By the end of the year 2021, when we found the house, the mortgage rates were floating around 2 percent, but it was still possible to find an offer a little bit under. While we were talking to the mortgage advisor and looking into the offers from the banks, the rates were steadily rising. The offer we accepted in the end, more than two months later, was already over 2 percent.

Right now, in the middle of 2023, it would be twice as much.

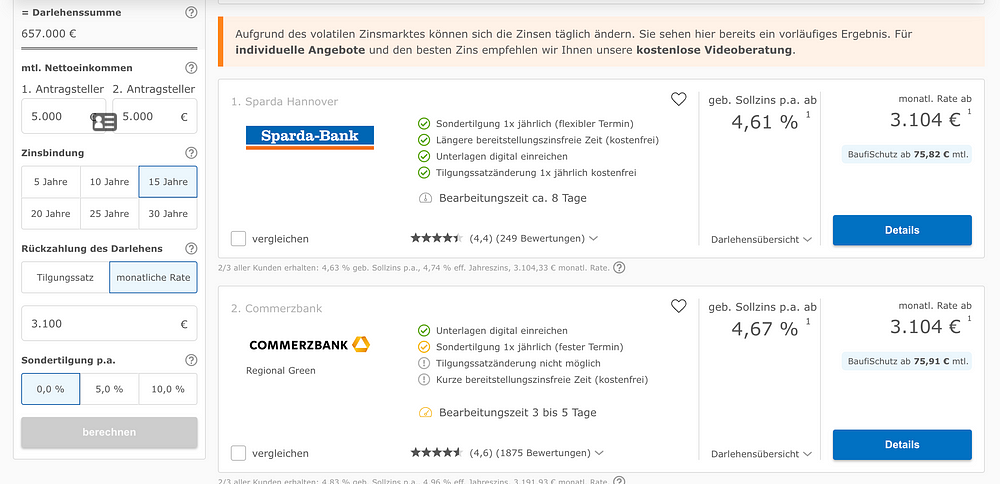

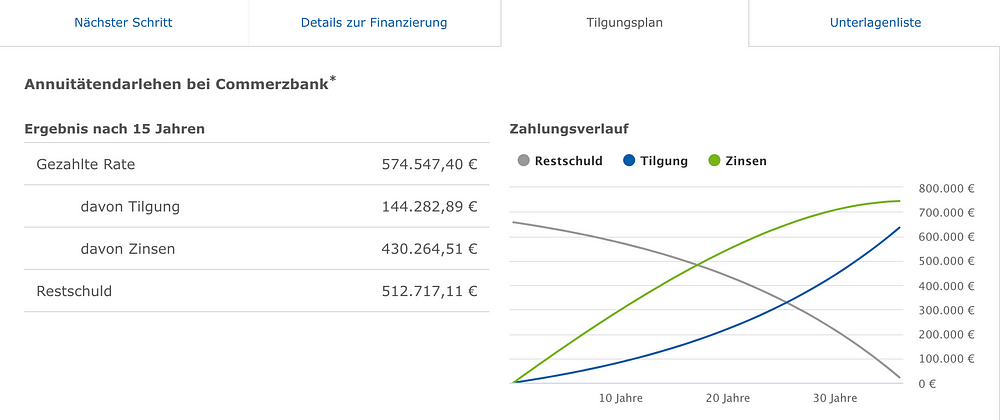

Suppose someone was to take one of the current offers from the picture above. The Commerzbank one. What happens after 15 years of fixed monthly payments?

So after 15 years, 575,000 euros is paid, but 513,000 euros is still outstanding. Remember, the total amount of the loan was 675,000 euros.

How come it’s not even half-paid? Well, because the interest rate ate up 430,000 euros out of those paid.

How long, then, until this loan is paid off? I will tell you.

36 years, 7 months.

If we were to do it now and not 18 months ago, I know we would not be getting that loan. We just wouldn’t live long enough to pay it off.

What this means is, even if the houses get cheaper, the money isn’t. This is supported also by the graph below, borrowed from a post on the Interhyp website.

This is why with the house prices in Berlin stagnating or even pulling a little back, people are way more wary of getting into the mortgage now. No one wants to borrow while the money is expensive, and then pay a fixed rate and see that it actually becomes cheaper. Many simply can’t afford these rates. We wouldn’t be able to, either.

Obtaining the mortgage: personal experience

As expats in Berlin and not speaking perfect German, dealing directly with the banks was something we’d have preferred to avoid at all costs. That’s why even before we found “the” house, we were looking into companies that made it easier.

In Germany, two such companies that we found were Hyporfiend and Interhyp. Hypofriend even had this nice calculator on the website that allowed you to calculate how much of a loan you can afford.

That’s where they shot themselves in the foot, though.

We don’t complain about our income. We’re both highly qualified and quite well-earning software engineers with a lot of experience, so kinda on top of the food chain … well if one doesn’t take into account the real rich people.

But however I tried to tweak that Hypofriend calculator, the amount it proposed to us was well below the one we needed. So I gave up and scheduled a call with the Interhyp advisor. We were even lucky enough to find one speaking our language though she lived in Leipzig, not Berlin. But since all the calls were happening online anyway, no one cared.

Important information: these services are free for house seekers. My guess is, they get their commission from the banks.

During the initial call with the advisor, she assured us that the amount we wanted would be indeed possible to obtain.

The Interhyp website allowed us to enter the data for all the houses that we were looking at, calculate the proposed mortgage rates from different banks, and see how the terms changed while tweaking the conditions. Variables include for how many years would we want to get the loan; how much of a down payment we wanted to bring in and how many years of fixed mortgage rate to have.

For some houses, the advisor warned us off, saying that the official assessment won’t be high enough.

One more thing to keep in mind:

More expensive houses – those costing more than 500,000 euros – will probably entail an assessment by the bank. The mortgage has some flexibility in relation to that assessment because the bank takes into account the market situation, too.

But if the actual price of the house exceeds the assessed one for more than 20 percent, max 30 percent (but that’s a big stretch), you will get a “no” from the bank.

Not getting a loan … and getting a loan

Even though we didn’t go to the bank ourselves, it was still a disappointment when the first bank we applied to via a consultant rejected us. The advisor said not to worry, this bank had a high rejection rate and it was a long shot … but our clock was ticking.

The reservation fee, remember?

So it was with great apprehension that we, via the same advisor, sent an application to the bank where we actually had all our savings and our accounts. The bank that we started with in Germany and where we were still clients.

The big old Deutsche Bank.

A week or so later, the advisor scheduled a call with us and said that she got good news and bad news.

The good news was, we got the loan.

The bad news was, not quite under the same conditions.

Instead of the simple loan we wanted, the bank proposed to split it into three parts, each with its own rate and its own maturity. One of the parts would also require an additional contract because it would come from Bausparkasse, not from the Deutsche Bank itself. As the advisor said, this is additional security for the bank. This is how they are hedging the risks.

We sighed and looked at each other‘s longish faces, but you remember the ticking clock?

We bit the bullet.

Aftermath

We signed the mortgage contract in February 2022, and the contract for the house a month later. In October 2022, the developer did a handover of the house. It took us several months to get the paintwork, flooring and kitchen done because we were doing it in stages as soon as we managed to save some money for each following step. Also, Germany isn’t famous for being lightning-fast with these kinds of jobs — our kitchen, for example, was ordered in June 2022 and installed in … January 2023.

In April 2023, we moved in.

Maryna Kryvko

Maryna Kryvko is a software developer in Germany. Maryna also writes a programming blog to share her knowledge. She sometimes speaks at conferences, though being an introvert, writing comes more naturally. Maryna says she’s not a professional writer but writing is something she likes, “and I think I can do it pretty well.”