(Editor’s note: This is Pt. 2 of a three-part series on buying a home in Berlin. You can see Pt. 1 here. You can read Pt. 3 here.)

As soon as we settled in Berlin from Ukraine, worked here for a few years to get permanent residence, and saved some (not much) money, I started persuading my husband that it was time to think of that house.

Here’s what we learned on our journey to find a place of our own.

Sniffing around the edges

The areas of Berlin that would fit into our budget were either in the north or in the east, neither of which we wanted very much. We still went to some viewings there. In fact, we probably went to 10 or more. Some houses were really, really nice, almost new, well built, with great interiors.

But the areas just left me thinking that they wouldn’t be a fit.

Something was always wrong. Too far from the transport connection; too many high-rise buildings in the area; too industrial; too boring.

In short, it was just not Zehlendorf, which I already knew like the back of my hand, and where we had all the infrastructure – doctors and pediatricians, childcare, shops.

This left one other option: to look into the suburbs or the satellite towns.

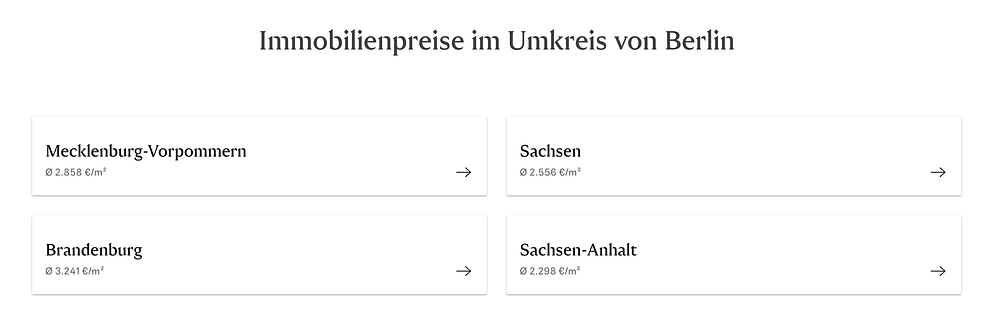

Germany is split into federal lands, something like the states in the United States. But the federal state called Berlin only includes … Berlin. There are no other towns; it’s like the Luxembourg of federal lands. Whatever is around Berlin is located in Brandenburg. And as you can see above, the prices in Brandenburg are much more … let’s call it “people-friendly.”

We still needed to commute to Berlin though, and this meant that the commute should be realistically manageable. So our first choice would be towns that were connected to the Berlin public transport systems. Ideally, the S-Bahn.

There are not many places like that, but they do exist. Potsdam, for example, is on the S7. Or Teltow, on S25. Both these towns were also expensive, though. For Potsdam, the average price of a square meter for a house of 100 square meters was actually higher than in a lot of Berlin areas.

But we liked Teltow. It was small and green, very close to Zehlendorf geographically, but closer to cheaper areas of Berlin in terms of price. One could find a house of 130 square meters under 700,000 euros there. In fact, the one we found was 137 square meters and 675,000, though as you will read later, it was a new building, still being built so we needed to wait for it.

It would also not come completely done when finished, which meant it required some additional investments.

But let’s also talk about other additional expenses. The extras, aka Nebenkosten.

How much is the fish, take two: extras

In Germany, buying a house comes with a lot of additional costs (Nebenkosten).

The list looks like this:

- Property transfer tax (Grunderwerbsteuer) — 3.5 to 6.5 percent in different Bundeslands;

- Real property tax (Grundsteuer) — up to 1 percent;

- Notary and land registration fees — 2 percent;

- Real estate agent fee — usually around 7 percent, but split between the buyer and the seller. Some places come without a real estate agent, but those are a rare find;

- If the house is newly built or — the opposite extremity — not in a great state, there might be additional renovation costs. For example, ours was a new building that came without flooring, paintwork, a built-in kitchen, garage door, shower stalls (they built the showers themselves but no cabins), and also without other small things that tend to add up. Such a situation doesn’t happen very often, though. Usually, the developer of a new house does at least the floors and walls.

What one needs to know is that all these costs are NOT covered by the mortgage that German banks provide, which means that they should come from your own capital.

As these costs can easily come up to 10–20 percent of the house costs (6.5 percent property tax, 3.5 percent real estate agent, 2 percent to the notary, 1 percent land tax is already a total of 13 percent, and there can be much more depending on the renovation costs), it’s no trifle.

Say that the house costs 600,000 euros and you have 100,000 euros. You may think that you have 16.6 percent of the initial cost and therefore can afford a down payment of the same value. But in fact, if the extra costs are 10 percent, so you only have 6.6 percent for the down payment and a lot of banks will not want you. And if the extra costs are 15 percent, your potential down payment shrinks to a miserable 1.5 percent and I am sorry to say but all the banks will probably say no. Save some more money and come back later.

But I am being too hasty. We can’t come to discuss the banks and mortgages before we’ve found the house. And that in itself is no easy feat.

Looking for a house within the budget

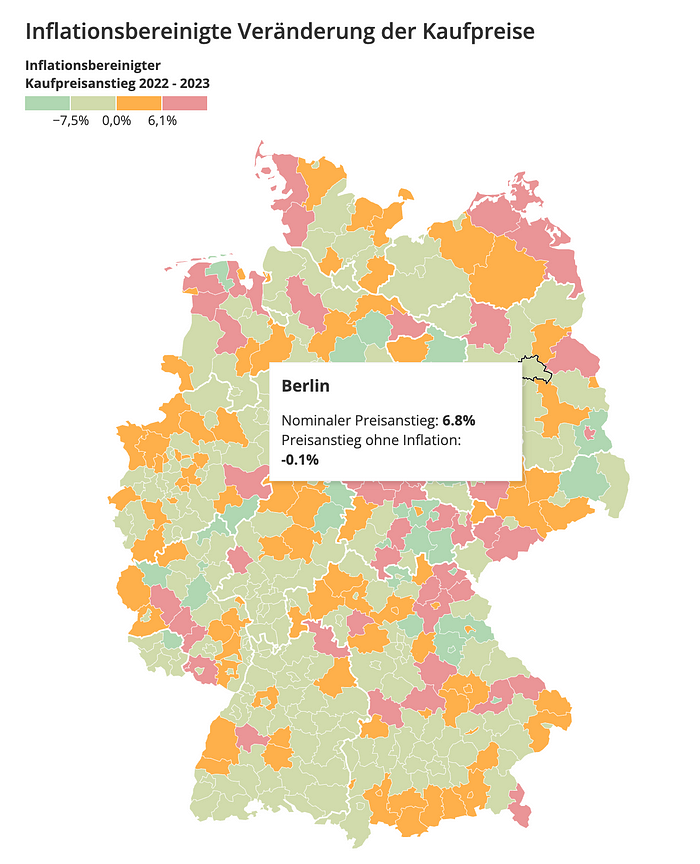

The inflation in 2022 and 2023 has been rising faster than the mortgage rate in some federal states, which makes analytics indicate the real prices have been sinking.

I could note that this “sinking” isn’t easily felt by a person with an income which, indeed, no one thought to also correct based on the increasing inflation rates. But maybe in a perfect world, someone has a perfect income, which increases perfectly in sync with those rates, or even faster.

Let’s all pretend to believe that.

Oh, and by the way, even though the prices are supposedly getting lower, the real estate market in Berlin is still very much a seller’s market, where a house viewing might bring a lot of visitors. And this means that even if you applied for a house, it’s not at all guaranteed that you will get it.

We started searching for a house at the end of 2021 when the market was still very much on the rise. Our initial requirements were a house under 700,000 euros, but with at least four bedrooms because we wanted a master bedroom, a nursery, a guest room and a home office.

Like everyone else, we wanted a good connection to public transport, a bearable commute to the center of Berlin where we both worked, and a quiet green area with as many private houses as possible, as opposed to huge blocks of flats. We both grew up in huge honeycomb-like apartment buildings, and I for one never wanted to live in such a place anymore. Since these apartment buildings were in abundance in East Berlin, we preferred to stay in the West.

Such requirements didn’t leave us with much of a choice, but in the end, we found something. It wasn’t a free-standing house, though; not even a half-duplex. It was a townhouse in a newly built area in Teltow, a quiet satellite town on the border of Berlin, but still on the S-Bahn railway, though our S-Bahn station was the end of the line.

The townhouse had a tiny handkerchief-like lawn, but it was still enough to put a grill on it and throw in some garden furniture, and what more did we need? We could even fit a very own sandbox for our small son.

What was left is to get it paid for.

This actually entailed another expense — a reservation fee. We already knew that dealing with the banks won’t come easy or fast, because we already lost one house to the long-processed mortgage application. Someone else was faster financing the deal and got the house. This time, we had the option to reserve the house for three months and pay 1 percent of its cost for it.

If we were successful in obtaining the mortgage, this payment would go into the down payment. If not, it would be lost to us forever.

We paid the reservation fee and ran to get that mortgage.

Coming up in Pt. 3 – The cost of money

––––––––––

Read more about Berlin here in Dispatches’ archives.

Co-CEO of Dispatches Europe. A former military reporter, I'm a serial expat who has lived in France, Turkey, Germany and the Netherlands.