(Editor’s note: This post about getting your Auto-entrepreneur tax status originally appeared on The American in Paris website. It’s reposted here with permission. With Paris increasingly becoming a hub for startups, we’re posting it as part of our Tech Tuesday series.)

Many people dream of living and working in France, and while I was right there with you when I first got here, I know that I had a tendency to put the logistical side of everything on the backburner. Thinking about taxes and the like just didn’t fit into my “Midnight in Paris” vision of what I wanted my life to be like here.

I was soon brought back down to reality when I finally got settled into my new post-master’s-degree life. I had already been in France for some time at that point, but I worked as an au pair (the family I worked for paid taxes on me), and after I was a full-time student (I traded English lessons for my apartment and took other odd jobs to make a little cash on the side). I knew I wanted to pursue freelance writing as a career, but I was unsure how to do so legally (plus how to get the benefits that I knew came from paying taxes here).

I was soon introduced to the concept of the auto-entrepreneur. There is no literal translation for the term, but it should be understood as a one-person business. If you’ve also seen the term micro-entrepreneur floating around, it’s because in 2016 the French government officially changed the term from “auto” to micro-entrepreneur. However, although it’s been officially changed for five years now, most people continue to call it the latter and even the website you’ll use to open your business and pay your social charges features the word auto-entrepreneur.

That’s France for you!

Similar to the 1040 freelancer tax status in the United States, opening your own one-person business is a great way to freelance legally in France. If you have a valid residence permit that permits you to work in France (sorry Visitor visa holders!), you’re eligible. When I got started myself, I found the process confusing and so I created this guide to help anyone else who may be in the same position.

Registering as an Auto-entrepreneur

I want to clarify one more time that the terms auto-entreprise and micro-entreprise are one and the same, and both signify a one-person business in France. Once you open your business, you become an auto, or micro, entrepreneur. There are a few different ways to open your business:

- In-person, at the Centre de Formalités des Entreprises (CFE) closest to your residence (a quick Google search will help you determine which one).

- By mail, but filling out the form on this website (click on accéder au formulaire) and sending it to the correct CFE.

- Online, by visiting this website.

I recommend you do the online option unless you’re eager to practice your French or use your printer and pay for postage.

Once you visit the website, follow these instructions:

- The first question is asking if you are already an “independent worker,” which is yet another term for auto-entrepreneur. You are allowed to have up to two small businesses, but if you’re reading this how-to article I’m assuming you don’t have one already. Check the box that says “non.” Then, click the button that says “déclarer mon auto-entreprise.”

- You’ll be asked to create an account, which you’ll need to pay your social charges and to have access to any sort of information related to your new small business. Fill in your personal information and then click on “créer mon compte.” You’ll have to confirm your email address and then sign in to your new account before you can move onto the next step.

- Once you’ve signed in, you’ll see a message at the top of the page asking you to complete the process to create your small business (Pour effectuer votre formalité…). Click on it.

- You can now finally get down to business. Fill in the necessary information, including what you plan on doing, when you want to start, and some other questions. The nice thing about the process (which didn’t exist when I opened my small business) is the small question marks next to each step that you can click on if you’re confused.

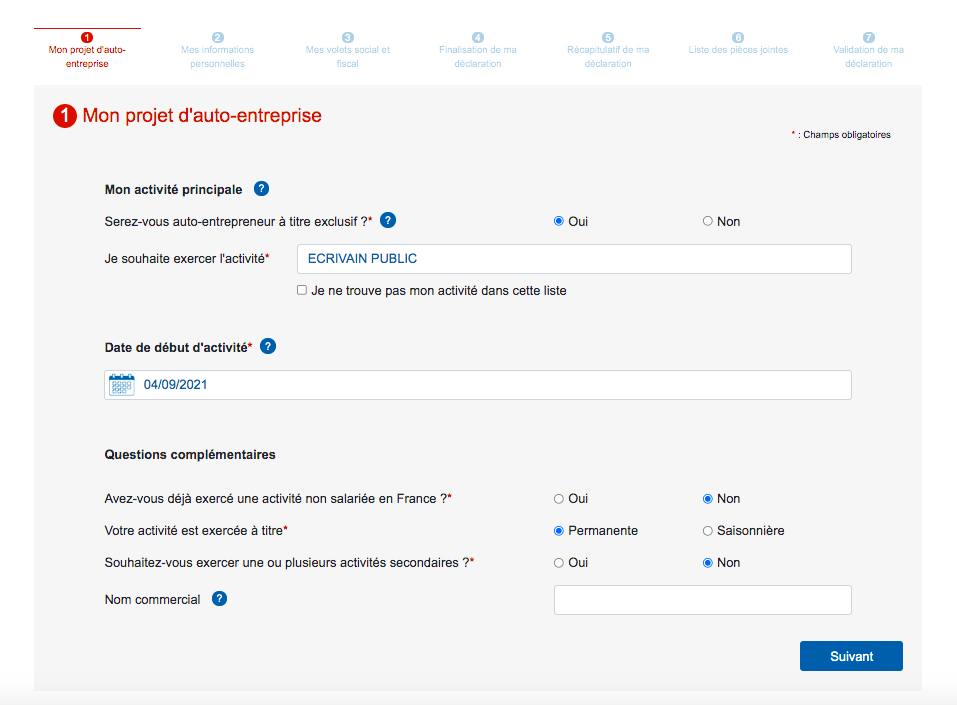

- Below is a screenshot for reference, of what I would put if I were to sign up for a small business for freelance writing:

- Click on “Suivant.” Here, you’ll be required to fill in your personal information like your address, date of birth, and the like. You’ll also need to put your nationality, and here you’ll be prompted to put in your residency permit number.

- Click on “Suivant.” This next section has to do with your marital status and your monthly social charges. If you already have a social security number you can put it in here, otherwise, click on the box that says “Ce numéro ne m’a jamais été attribué.” You’ll be able to choose the frequency of your social charge payments. I personally prefer monthly payments, but you can also opt to pay each trimester. There is also the option to pay your yearly taxes at the same time as your monthly social charges. Again, this is all preference! IF you’d like to separate yourself legally from your business (similar to an LLC in the US), check “oui” next to the option to become an EIRL.

- Click on “Suivant.” You’ll want to check “non” for the first question as you’re creating the business for yourself. Check “oui” for the second question, you’ll need the SIRENE for your future business dealings!

- Click on “Suivant.” You’ll be brought to a summary of all of the information that you’ve filled in so far. Review it and edit if necessary.

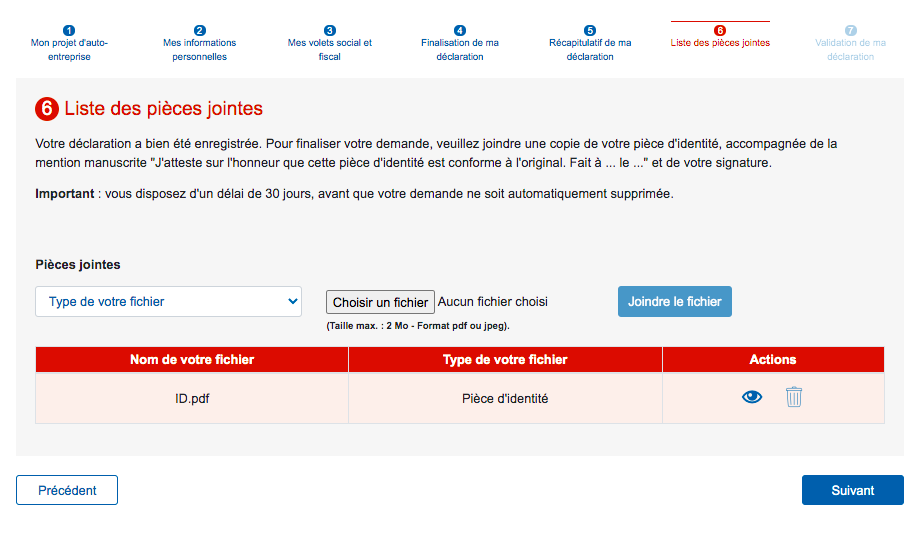

- Click on “Suivant.” Here you’ll be required to upload a copy of your ID and your valid residency permit. This next part is a bit tedious, but you’ll have to scan and print out your documents and sign with the words, “J’atteste sur l’honneur que cette pièce d’identité est conforme à l’original,” Plus, “Fait à … le …” with your location as well as the date. Then, re-scan this document and upload it onto the site. Make sure you click on “Joindre le fichier” after you’ve selected the document from your computer. You should then see it below like this:

- Click on “Suivant.” You’ll be taken to a confirmation page with the option of downloading your application and I recommend that you do so for your own records! If you followed the steps above, you should receive a confirmation letter from INSEE, the institute responsible for managing all small businesses in France. In the letter is your SIRET, which is the ID number assigned to your business. You’ll be required to put that number on any invoices you send to your future clients!

Paying Your Social Charges as an Auto-entrepreneur

Now that you’ve set up your new small business in France the next step is to start working! I wanted to include a note on paying your charges. Whether you opt for monthly payments or each trimester, you need to stay on of them to avoid paying late fees. You can use the same website that you used to create your business to tell the French government how much money you made and to pay the social charges based on how much you earned.

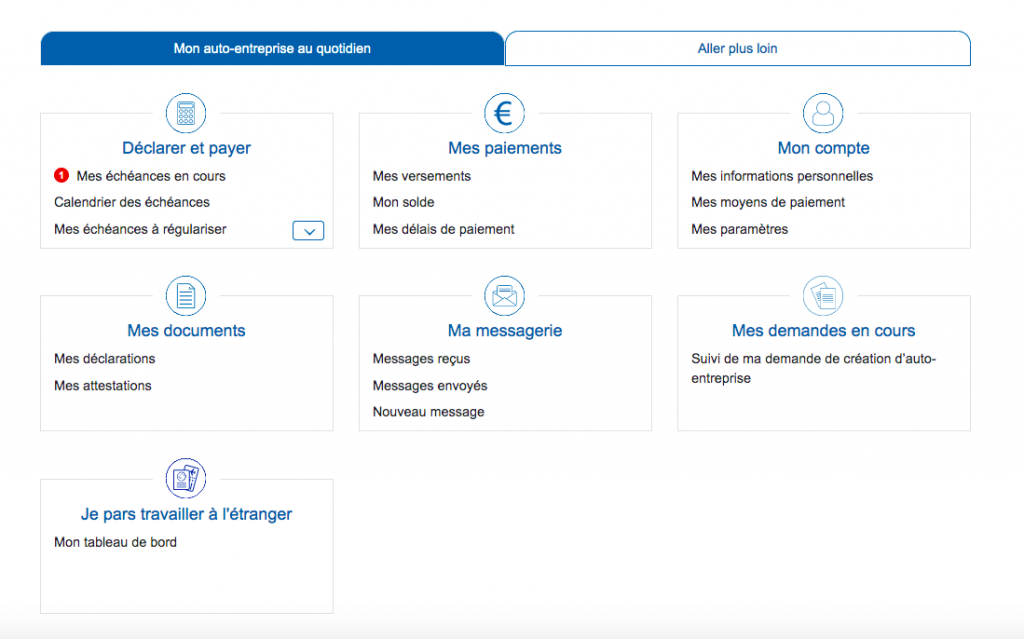

- Sign in to your account. You’ll be brought to the homepage:

- Under “Déclarer et payer” click on “mes échéances en cours.” You’ll see a red “1” if you haven’t filled yours out yet (like me, as of writing this article!). Click on the month that you need to pay. Here you’ll fill out your earnings. There are different categories depending on what your small business does. If you offer a service, such as writing, put your income in the first box. If you make things, like pastries, for example, put how much you took in as a salary in the second box, and in the third box how much money you made from actually selling the pastries.

- Click on “Suivant.” You’ll see here how much you owe the government. As a small business owner in France, you’re required to pay about 23 percent of your income to social charges. This the price of advantages like low-cost health care and other such benefits. Click on “Valider” to confirm that you agree with the amount.

- Here you can enter your bank information if you haven’t already. I usually click on “Payer via ce mandat” right away so that it’s taken care of. You won’t see it deducted from your account until the beginning of the next month.

Congratulations, you’re officially a small business owner in France!

Molli offers private consultation services which range from help with visas, adjusting to life abroad, to Paris travel itineraries. Click here to learn more.

About the author:

Molli Sébrier has lived in Paris since 2014 when she decided to leave her American life behind and pursue her dream of becoming a writer. Since living abroad, Molli has earned her master’s degree in English Studies with a concentration in literature and is now working towards making that becoming a writer thing happen.

If you’re interested in following your own dreams of moving to France, she also offers consulting.

You can follow her journey on Instagram @mollim, and if you like to read, Molli runs a female-focused book review website called The Mistress of Books. You can also follow her website on Instagram @themistressofbooks.

See more from Dispatches’ France archive here.

Molli Sébrier has lived in Paris since 2014 when she decided to leave her American life behind and pursue her dream of becoming a writer. Since living abroad, Molli has earned her master’s degree in English Studies with a concentration in literature and is now working towards making that becoming a writer thing happen.

If you’re interested in following your own dreams of moving to France, she also offers consulting.

You can follow her journey on Instagram @mollim, and if you like to read, Molli runs a female-focused book review website called The Mistress of Books. You can also follow her website on Instagram @themistressofbooks.