France may have many, many problems, from terrorism to an aging population. Yet it remains one of Europe’s hottest commercial real estate markets. France ranks only behind Germany in annual real estate investment in all three categories – office, retail and industrial, according to Los Angeles-based CBRE, the world’s largest real estate network. And now, it’s pushing for No. 1 with a mega-project.

EuropaCity hasn’t gotten much publicity in the English-language media except on commercial real estate sites and entertainment sites such as Deadline.

In fact, to get the details, we had to dig up a joint news release in French from the Paris city government, as well as an article from LeParisien to get the details. And they’re stunning.

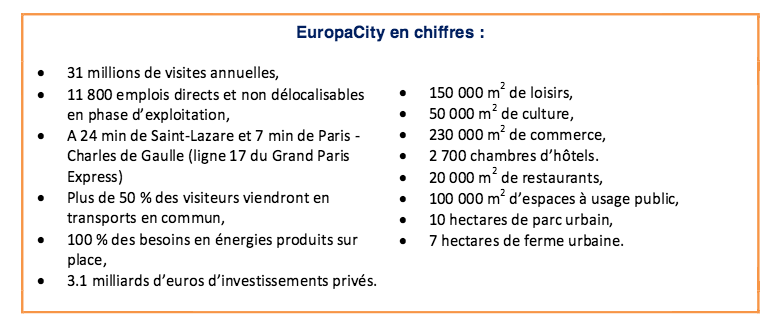

The project is planned as an almost self-contained city, with cultural/arts/museums, leisure, restaurants and retail, hotels and urban parks, according to the EuropaCity news release from earlier this year. Plans include 25 acres of leisure spaces, including a theme park, 12 acres of cultural space, parks and sports venues to retail, hotels and restaurants spread out over 200 acres just southwest of Paris Charles de Gaulle Airport. There are plans for a 2-acre water park, as well as an urban farm. And all this will be just 10 kilometers from the center of Paris.

Last week, it appears the funding fell into place with a commitment from one of the world’s richest moguls.

LeParisien calls the EuropaCity project one of the largest Chinese real estate investments in the world. Like us, you’ve probably read about a lot of grandiose projects that never came to fruition. But this one seems to have a solid commitment from Dalian, China-based Dalian Wanda Group. Dalian Wanda announced last week the giant commercial/retail developer will invest $3.3 billion through 2024 in EuropaCity. The commercial property development company is controlled by Wang Jianlin, China’s richest man. Technically, Wang is investing in Alliages et Territoires, the company overseeing EuropaCity. In turn, Alliages et Territoires is part of Immochan, the property-investment unit of private French supermarket company Auchan, one of the world’s largest food retailers.

“We have wanted to develop ourselves in France for a while, and particularly in Paris, as I had told the French President (Francois Hollande) during his visit to China last November,” Wang said in a statement. “EuropaCity allows us to finally reach that objective, and we are pleased to collaborate with a famous French stakeholder to develop this ambitious and innovative project. For us, it is the most important project outside of China.”

EuropaCity is far from the only thing Dalian Wanda Group has going on. The company is heavily invested in movie theaters and entertainment and just acquired a big Chinese movie studio. Dalian Wanda acquired the U.S.-based cinema operator AMC Theaters in 2012 for $2.6 billion. Wang also is proposing a 3 billion pound theme park and shopping center in London, according to the Sunday Times. Both the French deal and the London project seem to have come together last month after Wang did a whirlwind tour, meeting with both Hollande and British Prime Minster David Cameron.

Will it all actually happen? Who knows … 2024 is a long time from now, and it’s no secret China’s economy is slowing. But Dalian Wanda has a global real estate footprint, as well as malls, theme parks, luxury hotels and cinemas in at least 100 cities across China. It also owns Wanda Commercial Properties, China’s largest commercial real-estate developer. So, EuropaCity fits neatly into Wang and Dalian Wanda Group’s portfolio … and Wang’s aspirations to hedge against over-reliance on China by diversifying, expanding into Europe and the United Kingdom.

Here are some notable recent developments:

• LA-based alternative investment fund Ares Management announced in early February that a real estate fund it manages acquired two designer outlet centers in France for about 200 million euros. The outlet malls are in the regional cities of Troyes and Roubaix. (The Troyes location reportedly is the largest outlet center in France.) They were owned by Resolution Property, based in London. The centers will continue to be managed by London-based McArthurGlen, which has now has a minority investment in the centers as part of this transaction, according to a news release. In aggregate, the centers comprise a total of about 47,000 meters square and feature tenants such as Polo Ralph Lauren, Nike, and Hugo Boss.

• Real-estate crowd funding is a big hit in France, according to a post on Crowdfundinsider.com. Introduced in late 2014, crowdfunding platforms have already raised 40 million euros.

From the post: Demand from French retail investors is strong. French small savers love real estate. They invest around 60% of their wealth in housing and land and generally underestimate the risk of this asset class. Thanks to crowdfunding, they now have the opportunity to start a diversified portfolio of small real estate investments.

The whole thing is so successful that French regulators are now worried there are too many crowdfunding sites.

Co-CEO of Dispatches Europe. A former military reporter, I'm a serial expat who has lived in France, Turkey, Germany and the Netherlands.