Dispatches’ raison d’etre is based on the belief – nay, the certainty – that Europe has sufficient educational infrastructure and talent to someday make it a three-way race to digital dominance, catching the United States and China.

The bad news is, there are big pieces missing here in the European startup matrix. Europe lacks both a ruthless, hard-driving 24/7 American-style startup eco-system and early access to capital. European angel investors typically don’t see why they should take any risk, preferring to come in during later rounds after a startup has proven the concept.

But here’s the deal: We’ve always said, “Europe might have the brains, but the U.S. has the chutzpah!” We see the Europeans turning to Americans to do the intensive development work to quickly turn their engineering advantages into products. Interestingly, VC Vivek Goyal just made that same point in his insightful post for VentureBeat, “A year investing in European startups: Here’s what I’ve learned.”

What Goyal learned is, European entrepreneurs need to go big or go home.

From the post:

If there is something that European companies can learn from their US counterparts, it is global ambition and aggressive execution. Most European entrepreneurs strike me as humble when pitching their businesses, no matter how great their product is. Coming from India and having worked in the US, I am used to pitches being about global ambitions and thinking big from the get-go.

Still, it’s clearer every day Europe is making its move … at long last. Now, you’re saying, “Okay, aside from one post, where is the empirical data behind your analysis?”

We culled through recent media stories for an overview on where Europe tech is heading, and here’s what people a lot smarter than we are are thinking. Goyal, with Nokia Growth Partners, moved to Europe after investing in the U.S. and India, thinking the European tech ecosystem would be much smaller. His takeaway – “The European tech industry has more scale and intricacies than you might think.”

Goyal makes a lot of the same points we’ve made over the past months including Europe being stronger in certain sectors such as fintech and music (though you have to wonder how long it will be till Daniel Ek gives up and sells Spotify to an American company.)

For the first time ever, fintech is the most popular investment category in the Nordics, according to a report by accounting and business consulting giant KPMG. Between January 1, 2014 and end of March 2016, 51 fintech investments totaling $390 million were made in aggregate in companies in Sweden, Finland, Norway, Denmark and Iceland. Year-on-year investments in fintech companies increased by 106 percent in 2015 to $13.8 billion, according to a KPMG report.

However, Goyal indulges in some false equivalencies, comparing derivative European Unicorns such as Zalando and Rocket Internet to U.S. digital giants, which created entire tech sectors rather than copying someone else’s tech and business models.

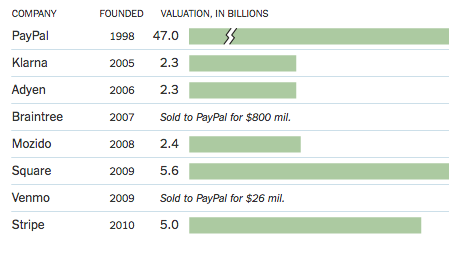

Moreover, if you look closely at fintech, the U.S. remains dominant. No. 1 PayPal, with an 18-year headstart, is valued at $47 billion while Swedish Unicorn Klarna and Amsterdam-based Adyen are both valued at $2.3 billion.

Moreover, if you look closely at fintech, the U.S. remains dominant. No. 1 PayPal, with an 18-year headstart, is valued at $47 billion while Swedish Unicorn Klarna and Amsterdam-based Adyen are both valued at $2.3 billion.

The PayPal Mafia including Peter Thiel and Elon Musk are using their billions to start world-changing tech companies such as big-data intel giant Palantir in Theil’s case, and Musk’s Space-X –which just landed a rocket on a ship – and Tesla. The reason Thiel, Musk and Co. are uber successful (pardon the pun) is because they’re hard-driving egomaniacs obsessed with business.

(To be fair, in his post, Goyal notes in his post how European startups pretty much ignore employment laws: “The new species of European entrepreneur is willing to give it all, not worrying about the time of the day or the day of the week.”)

By comparison Europe’s tech billionaires – all three of them – are nice guys, taking summers off and still playing in the VC junior leagues.

Last month, TechCrunch had a post by Atomico co-founder and partner Mattias Ljungman, “As Silicon Valley chills, Europe’s tech gets hotter,” advocating the position that Europe won’t be slowed by trends in the United States, where A rounds are diminishing, down rounds increasing and valuations shrinking. Ljungman argues Europe has now laid the foundations — talent, mentors, angel investors, local VCs, incubators, accelerators and communities — that are propelling Europe “on its own, separate investment cycle.”

For the record, Atomico is the Swedish investment fund created by Spotify co-founder Daniel Ek, so Ljungman is, like us, a cheerleader for Europe. Ljungman cites data on A rounds, capital invested and $100 million-plus exits from Dow Jones VentureSource, CB Insights and S&P Capital IQ. His conclusion? “Europe is now starting to fire on all cylinders, much like Silicon Valley did in 2013.”

What’s lost in all this is perspective and the fact that “tech” is a pretty nebulous term. Clearly, Europe has pockets of success, and areas where compared to the U.S., nothing much is happening at all even if valuations are lower and A rounds are down in Silicon Valley. To his credit, Ljungman points out that the context for a Europe v. Silicon Valley comparison is that “the Valley has been on fire since 2008, and Europe has only really got going in the last three years.” And just getting started, if you follow that line of reasoning.

Trouble is, a lot of the most dramatic developments in the Old World involve American companies pouring billions into Europe, investing in everything from acquisitions to creating new incubators and accelerators.

Now, American companies are racing the Chinese to start or expand European operations. Intel executives just announced their third acquisition of a European startup this year: Italy-based IoT security startup Yogitech, which had raised less than 3 million euros in Europe to date.

Google announced it’s sinking more than 27 million euros into projects spanning the European news tech scene. The fund’s goal is to “help stimulate innovation in digital journalism” over the next three years, Google’s CEO Sundar Pichai said at an event in Paris last week. The project is the first from a 150 million euro fund the company announced last year.

Pichai said Google wants to fund automated content personalization and robot journalism, hoax-busting apps and tools to verify social media in real-time reporting.

Amazon, Cisco, Apple, Oracle and every other American tech company is chipping off pieces of Europe’s golden 750 million person market. But lost in the headlines about the sexy American digital giants is that the Chinese are chest bumping the Americans as they carve out their piece of the action.

A few days ago, CNBC reported Chinese E-commerce titan Alibaba is rolling out its Alipay payment app in Europe so Chinese tourists can buy more stuff on vacation. The news site describes as “Alibaba’s biggest push out of Asia yet.” And by the way, Alipay has 450 million users in China, of whom 120 million used the app while abroad. Which all totals up to an astounding 170 million transactions per day, according to CNBC.

Alibaba cut a deal last year with German payment processor Wirecard that gives Alipay’s customers point-of-sales terminals. So, between Alibaba and Amazon, how much room does that leave for European E-commerce, fintech and transaction firms?

The truth is, even in a recession, giant American or Chinese digital firms could just buy Europe with the cash on their balance sheets if they choose. European policymakers have a choice. They can recruit American entrepreneurial and tech talent to juice its consumer-facing digital scene the way the Japanese leaders brought in industrial efficiency pioneer Edward Deming after World War II, or they can be satisfied with their superiority in more conventional heavy industries such as precision tools, robotics, automotive and high-tech medical equipment.

No shame in that. But Angela Merkel and other EU leaders would kiss goodbye any chance of realizing their long-held ambitions to have their own Silicon Valleys, pumping out revolutionary technology year after year.

Co-CEO of Dispatches Europe. A former military reporter, I'm a serial expat who has lived in France, Turkey, Germany and the Netherlands.