(Editor’s note: This was first posted on January 31. We’re reposting this to remind you we’re down to the final days before April 15.)

BY DAVID McKEEGAN

Co-Founder, Greenback Expat Tax Services

As many expats know, the United States tax code changes every year. The U.S. Congress updates, changes, and adds tax laws yearly. It’s best to keep abreast of these changes, to be sure that you are not surprised when tax time rolls around!

Here is a list of the top changes that will affect US expat taxes for 2016.

1. Increase in exemption amounts for you and your dependents – Exemptions are a statutory reduction in your income based upon the number of people in your household; yourself, your spouse, and your dependents. This reduction in your taxable income lowers the amount you are being taxed on, and therefore your tax. In 2015 the exemption amount for each person was $4,000. In 2016, exemptions increase to $4,050 per person. Exemptions help U.S. expats by reducing the amount of tax on your return, and therefore lowering the amount of foreign tax credit needed to offset it; allowing you to carry more foreign tax to future years.

2. The Foreign Earned Income Exclusion is increasing – The Foreign Earned Income Exclusion (FEIE) is a major provision of the US tax code for expats. The FEIE helps to lower your wage and salary income, and therefore your taxable income. The FEIE in 2015 was $100,800; in 2016 that amount increases to $101,300.

3. You get extra days to file and pay your taxes – normally you have to file and pay your taxes due by April 15th each year. But this year, due to the “Emancipation Day” holiday in Washington DC, the tax return and tax payment date is April 18th for everyone! Expats still get an automatic 2-month extension to file their tax returns, but any taxes due need to be paid by April 18th in order to avoid interest charges.

4. Healthcare penalties are increasing – The Affordable Care Act, colloquially known as Obamacare, was designed allow for affordable health care coverage for all. The law requires that all people living in the U.S. have some form of health insurance, or face a tax penalty. The penalties started out small, to ease people into the new laws, but they are increasing! In 2015 the penalty for not having healthcare was 2-percent of your household income, with a maximum of $325 per adult and $162 per child. In 2016, the penalty is either 2-percent of your taxable income with a maximum of $695 per adult and $347 per child. That’s a 213-percent jump in the penalties! If you are a U.S. expat for the entire year, you do not have to worry about the provisions of the Affordable Care Act, as you qualify for an exemption from the penalties, but you still need to file the correct forms on your return showing that you are an expat!

5. Increase in the standard deduction – like the exemption amounts, the standard deduction is also being increased for some taxpayers. The standard deduction is a set amount, based on your filing status, which lowers your income – and therefore lowering your taxes. The standard deduction for single and married taxpayers stays the same as 2015 numbers; single and married filing separately $6,300, and married filing jointly $12,600. Head of household taxpayers (unmarried with dependent children) will see an increase to $9,300 standard deduction. Expats can file as head of household if they are married to a non-resident alien and have dependent children, taking advantage of a higher deduction!

6. FBAR deadlines are changing – FinCEN form 114, AKA the FBAR, has traditionally been due on June 30th each year for the reporting of bank accounts for the prior calendar year. For the 2016 FBAR deadline, FinCEN has changed the deadline to April 15th, with a two month automatic extension for filers living outside the U.S. If you need extra time to prepare and file your FBAR, you can apply for an additional extension, making your FBAR form due October 15th. This new deadline is for calendar year 2016, filing the form on April 15, 2017.

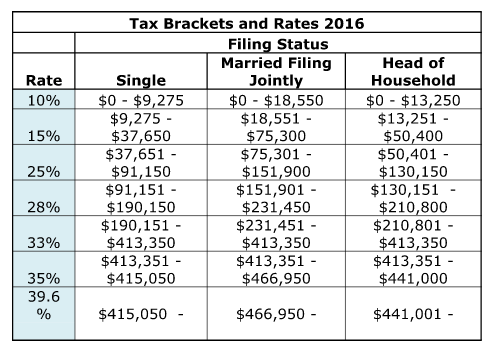

7. Tax Brackets are increasing – Tax brackets are the ranges of income that fall within the U.S. tax code’s income tax rates. The income for each bracket has increased slightly in 2016 to account for inflation. The U.S. tax system is a progressive tax system, as you earn your income during the year you progress through the different tax brackets. Your salary is first taxed at the lowest tax bracket, once you have earned more, the next portion of your salary is taxed at the next highest tax bracket, and so on. Tax brackets are important for expats who use the Foreign Earned Income Exclusion. Any excess income that does not get excluded on your return will be taxed at the highest tax bracket your whole income falls into, even if the total of non- excluded income would be in a lower rate. Here are the tax brackets for each filing status for 2016:

While this is not an all-encompassing list of the 2016 changes to the U.S. tax code, it does show some of the more important changes for the average U.S. expat taxpayer!

About the author: This post was written by David McKeegan, co-founder of Greenback Expat Tax Services. Greenback aims to take away the anxiety and hassle of helping US expats become and stay compliant with their US taxes while overseas. Learn more about Greenback Expat Tax Services here.