(Editor’s note: Americans have many comfortable retirement options in Europe. We’ve done some of your legwork for you with this second installment of our Retire in Europe series.)

Okay, first off, when we say “romantic” retirement destinations here, we’re not talking here about cuddling or whispering sweet nothings. Not that there’s anything wrong with that.

In this case, “romance” refers to the countries with cultural and linguistic ties to Ancient Rome – France, Italy and Greece. For a combination of urban beauty, fashion, great food and sunny shores, Middle and Southern Europe are packed with attractions, as well as the romantic Mediterranean lifestyle.

But Paris, Rome, Milan, Amalfi, Cap d’Antibes, Lake Como, the Greek Isles – the assumption is that all that usually comes with a price.

So how reasonable are those countries for retirees who are not George Clooney?

Let’s find out ….

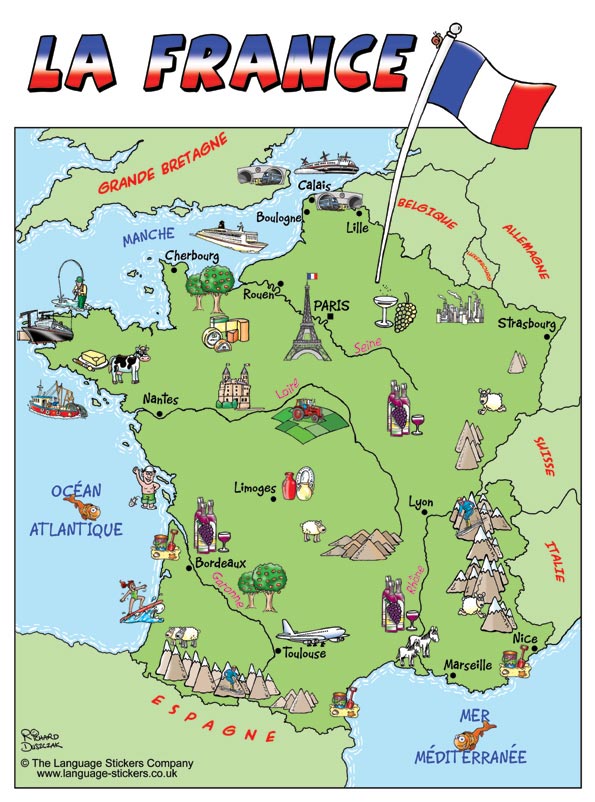

France

Ah, romantic France. (And here, I do mean the cuddling kind.) How beautiful, fashionable, warm and welcoming – okay, well, at least beautiful and fashionable.

Ah, romantic France. (And here, I do mean the cuddling kind.) How beautiful, fashionable, warm and welcoming – okay, well, at least beautiful and fashionable.

No surprise, living in Paris is really expensive. But living in rural France is super-cheap. And, in some instances, small towns will give you property on which there are delinquent taxes owed, just to get them restored and back on the tax rolls.

With its climate, food and wine, and laid-back lifestyle, France is a dream for many expats. For retirees, there’s an excellent health care system. And older people are really respected there.

Old or young, though, you’ll need plenty of documents for long-term residency:

• Your passport

• An application form, signed and legibly filled out

• A passport-size photo glued/stapled to the form

• Proof of means of income

• Proof of medical insurance

• Proof of accommodation in France

• A letter promising not to engage in employment in France

• Your marriage certificate, if applicable

• A long-term residence form, which must be completed, dated, signed and notarized.

All that said, the actual process of retiring in France is simple. You apply for a long-term visa at the nearest French consulate in your home country, after which you obtain a carte de séjour visteur.

You’ll also have to provide some kind of statement, from your pension plan or from Social Security or your bank to prove that you have the financial means to retire in France. Also be ready to prove either your current health plan will cover you in France, or you’ll obtain coverage once you reside there.

If you’re on an American pension, you can take it to France. Just inform the U.S. tax authorities that you’ll be paying French income tax on it. You’ll still, by the way, have to file a U.S. tax return every year, even if all your assets are in France and despite the fact that the U.S. and France have a double taxation agreement. You can only avoid U.S. income tax responsibilities if you renounce your American citizenship. Clearly, many Americans are reluctant to do that, even though there are financial benefits to doing so.

You may still be liable for the French wealth tax, or impôt de solidarité sur la fortune (ISF), if your assets are more than 1.3 million euros (currently $1.37 million). Then you’re taxed on everything over the first 800,000 euros (or about $845,000). This includes property, cash, investments, cars, household contents and personal possessions.

Paris

If you’re thinking of retiring to France, you probably don’t have to be reminded of the immense charms of Paris. Ah, those wonderful Parisians, with their insanely high cost of living!

Kathleen Peddicord, who writes about travel for the Huffington Post, said recently that “the street level costs of Paris” – to buy a hamburger, or a cup of espresso, or a baguette, or a metro pass, or a lightbulb – costs roughly double what it does on the West Coast of the United States. (Meaning much more than that for the vast middle of the country, until you get to New York or D.C.)

But, she also writes, “The strong dollar gives you more buying power in this city than you’ve had in more than a dozen years. [And] property values are down, including in some of Paris’ most appealing quarters.”

Not every arrondissement is as pricey as the word sounds. (Only in French could you imbue a term like “municipal district” with as much elegant possibility.) Paris’s 1st, 6th, 7th and 8th arrondissements – clustered around the Louvre, Royal Palace, Tuileries, Luxembourg Gardens, Eiffel Tower, Champs-Élysées and L’Etoile – are the most sought-after addresses and highest rents.

But, says Peddicord, “More interesting, from a cost-per-square-meter perspective, can be the 11th (around the Place de la Republique), the 18th (Montmartre), the 19th (home to Buttes Chaumont park and the popular Bassin de la Villette) and the [mostly residential] 20th (one of the most multi-cultural areas of this city), all neighborhoods enjoying gentrification and becoming increasingly trendy.”

(Editor’s note: We were in Paris this fall and stayed in the 14th. THE most authentic section of Paris, IOHO.)

If you’re thinking of purchasing your residence, it can be possible to borrow up to 50 percent of the purchase price. But the dollar is strong and there’s a buyer’s market in some neighborhoods.

France is more than Paris

Of course, France is much more than just Paris. There’s “the Midi,” France’s term for the deep South, including the French Riviera.

There’s Languedoc, also on the Mediterranean, between the Cote d’Azur and Spain; Provence, in the southeast part of the country, above Marseilles and Nice; Bordeaux, in the southwest of France on the Bay of Biscay; Brittany and Normandy, on the extreme northwest coast; and Dordogne, southwest of Paris in the great middle of the country.

Paris has a four-seasons climate of rain and some snow, hot summers, lovely autumns and, well, the songwriters have told you about April and the springtime.

In the rest of the country, Southern beaches outside Montpellier, for example, are mostly sub-tropical, the north can be cool and rainy, the east along the German border colder, Alpine regions the most wintry and snowy. Alsace-Lorraine, on the German border, also has colder winters.

Bordeaux, on the Garonne River in southwestern France, has a large, English-speaking expat community and a mild climate with warm summers, though rainy winters. There are numerous universities, thus a large student population, and traditionally a home for various immigrant populations, including Spanish and Portuguese Jews, North Africans, the British, the Irish and the Dutch.

Though Bordeaux is sometimes called “little Paris,” it might also be called “little San Francisco,” because of its food, wine and climate.

Languedoc-Roussillon is one of France’s less-expensive expat retiree destinations. An apartment might run $140,000, a mid-size house about twice that. And it’s just a three-hour ride on France’s high-speed train from Montpellier, the region’s largest city, to Paris.

Beautiful, artsy Aix-en-Provence has a large expat population and many students, but it’s also an expensive place to retire. Buying property is expensive, but renting is less-so.

Italy

Other than France, what European country stirs Americans’ hearts more than Sunny Italy? The Tuscan countryside, the beauty of the Amalfi Coast, bustling Rome, fashionable Milan, artistic Florence, historic Venice.

Other than France, what European country stirs Americans’ hearts more than Sunny Italy? The Tuscan countryside, the beauty of the Amalfi Coast, bustling Rome, fashionable Milan, artistic Florence, historic Venice.

Italy has a multitude of visas. If you’re planning on staying longer than 90 days, but aren’t yet sure about permanent residency, you’ll need a Schengen Treaty/Tourist Visa, which covers most EU countries.

If you know you want an extended stay and can afford to live there without working, the visa for you is the visto per residenza selettiva o dimora (elective residency visa). An Italian residency visa is issued solely to those who are planning to move to Italy.

It does not allow the applicant to work. Although U.S. citizens are unlikely to experience problems, having a residency visa does not automatically guarantee you entry to the country. The consulate advises that travelers carry with them copies of the documentation they submitted when applying for the visa, particularly those showing financial means.

The visto per coesione familiare is a visa for family members, applicable when the whole family is leaving and returning together and staying in Italy longer than three months. Besides the usual documents, you will need proof of the familial relations.

The visto per coesione familiare is a visa for family members, applicable when the whole family is leaving and returning together and staying in Italy longer than three months. Besides the usual documents, you will need proof of the familial relations.

No matter what kind of visa you are traveling under, you must – within eight days of your arrival in Italy – appear before the local police authority with your passport and visa in order to receive the permesso di soggiorno (stay permit), the only legal document that legitimizes your stay in Italy.

If you’re planning to find a job, a work permit must be obtained by your prospective employer and you must apply for a Working Visa from the Italian Consulate before coming to Italy.

Once you’ve cleared that arduous process, buying real estate in Italy is easy – just confusing as to where you want to retire. The cities, the countryside, the lakes in the north, the beaches in the south, the farms and vineyards in the center.

The bargain spots

The best areas of the best cities – Rome, Florence, Milan – are expensive. But there are parts of every Italian city and most of the countryside, that are surprisingly affordable. In rural areas and small towns, plenty of real estate is available for less than $100,000.

Greece

Set aside, for the moment, all you think you know about the Greek economy.

Set aside, for the moment, all you think you know about the Greek economy.

Greece is a beautiful country with a mild year-round climate, relaxed lifestyle and much lower-than-average cost of living. And there’s a relatively low cost of entry. To retire in Greece, you’ll need a residence permit, which you get by providing proof that you have an independent income of at least 2,000 euros per month – or roughly US$2,100.

You’ll have to buy health insurance. There is no public healthcare at all available to expatriates. The good news is, private Greek medical care costs much less than in the U.S.

You’ll also have to decide where in Greece you want to plant your flag. That depends on your lifestyle choice. Athens has urban sophistication, history, world-class museums and architecture. The island of Mykonos has nightlife, clubs, cafes, beach bars and that astounding view of the Mediterranean. (It also has the highest cost of living.) The Ionian islands – particularly Myrtos and Cephalonia – have the world-class beach life. The Peloponnese has the hiking-camping lifestyle. Crete has the mild climate.

Not surprisingly, those parts of Greece with the largest expat communities also have the most expensive cost of living. Your money will last longer if you choose a more remote area and live like a local. Living in a more remote area also means that you won’t see as many fellow Americans and you’ll have to learn to speak some Greek – the more remote locals don’t speak much English.

Also, remote means farther from the good doctors and hospitals found in the larger centers, such as Athens. If you expect to need ongoing medical attention, you should choose a more central location rather than a remote island.

(Editor’s note: Here’s one of our most popular posts about an expat in Greece.)

As for the Greek economy, its economic woes may not be resolved for some time. Most experts say renting is probably better than buying. And don’t put your money in a Greek bank. Use a large international bank instead.

But the shaky economy can provide some welcome bargains. Let’s say you’re starting with $200,000 in savings. A one-bedroom apartment outside the center of Kalamata, the Peloponnese peninsula just southwest of Athens (about 150 miles from Greece’s largest city) would run less than $300 a month, says the web site numbeo.com, a database about cities and countries around the world.

Utilities and Internet access might be another $150 a month. Then, says Numbeo, you might spend $250 on groceries, $25 on transportation and $150 on monthly household expenses.

“If you’ve budgeted $1,800 per month, that leaves about $955 for health insurance and other medical costs, plus dining out, entertainment and travel – and with any luck, enough left over to deal with emergencies.

“Now,” writes Barbara Peck on Investopedia.com, “deduct your monthly Social Security income from that $1,800 per month. You’ll be dipping into your savings to the tune of $465 a month, or $5,580 a year.

“At that rate, your $200,000 nest egg will last about 36 years.”

Seems like a pretty good long-term deal for someone 50 or older. And isn’t that what we’re talking about?