(Editor’s note: Americans have many comfortable retirement options in Europe. We’ve done some of your legwork for you with our Retire in Europe series.)

The Huffington Post recently called Portugal “the best place in the world to . . . retire that nobody’s talking about.”

Weather. Golf. Affordability. Got your attention?

American retirees with money saved up are processing all kinds of information about where life is sweetest and suddenly – for the obvious reasons – many are looking beyond the usual sunshine destinations of Florida, California and Arizona.

But if you’re thinking of spending your golden years in Europe, Portugal is only one European retirement option. We’ve surveyed the continent for places where the cost of living is manageable, entrance requirements are minimal, healthcare is available and life in the golden years can be sweet. All the things that retirees value.

Over the next few weeks, we’ll present several options to you. So let’s take a little tour – starting with the Western-most part of Europe, where the Atlantic Ocean first laps up onto the shores of the Old Country.

Today, we’re going to look at the sunny climes of the Iberian Peninsula. And let’s start with Portugal – not just because it’s closest to the U.S., but also because it seems to be everyone’s Number One retirement spot.

Portugal

Portugal certainly makes its case. The sunny coastal region of Algarve, in particular, is the very end of the European continent, and the beach-and-golf-resort tip of the Iberian Peninsula. Algarve has 3,300 hours of sunshine per year (for comparison, Miami has 1,776), as well as great beaches and resorts. Like Palm Beach and Santa Barbara, except with one of the lowest costs of living on the continent.

Portugal certainly makes its case. The sunny coastal region of Algarve, in particular, is the very end of the European continent, and the beach-and-golf-resort tip of the Iberian Peninsula. Algarve has 3,300 hours of sunshine per year (for comparison, Miami has 1,776), as well as great beaches and resorts. Like Palm Beach and Santa Barbara, except with one of the lowest costs of living on the continent.

According to HuffPo, “A retired couple could live here comfortably but modestly on a budget of as little as $1,500 per month. With a budget of $2,000 per month or more, you could enjoy a fully appointed lifestyle in the heart of the Old World.”

And more than 100,000 resident expat retirees (mostly Brits) currently do enjoy that lifestyle.

Algarve in particular, and Portugal in general, have what most retirees want, need and are looking for: good weather, a good healthcare system, fairly low costs, low/no crime, golf and untaxed retirement income.

Yes, you read that right. Retirement income is not taxed.

Recent legislation allows resident foreign retirees to receive pension income in the country tax-free. The law also provides for reduced taxation on wages, intellectual property, interest, dividends, and capital gains.

But don’t just take the word of the Huffington Post. Investopedia.com assures you that you can retire in Portugal with $200,000 of savings. The website Live and Invest Overseas has rated the Algarve region as the Number One retirement destination in the world two years in a row. International Living magazine has given Portugal an 84.8 out of 100 in its index of best places to retire.

And this is not just for the super rich. Kathleen Peddicord, founding publisher of Live and Invest Overseas, has noted that because Portugal hasn’t yet recovered from the 2008 downturn, the real estate market is still “depressed and undervalued.” In other words, there are bargains to be had for folks without huge savings or pensions.

Writing in US News and World Report, Peddicord stated:

The cost of living in Portugal is among the lowest in Western Europe, on average 30 percent lower than in any other country (in) the region. A retired couple could live here comfortably but modestly on a budget of as little as $1,500 per month. With a budget of $2,000 per month or more, you could enjoy a fully appointed lifestyle in the heart of the Old World.

The touristy Algarve, already loaded with expats, is just one option. You could also choose the sophisticated urban life of Lisbon. Or the less-crowded beach towns on the Silver Coast, north of Lisbon. Or the historic university town of Coimbra, in north central Portugal, a two-hour train ride from Lisbon. The school was founded in 1290, and it reeks of Medieval architecture. Also a vibrant bar scene.

Oh, and by the way, Portugal also has a growing medical tourism industry, particularly if you are interested in the aesthetic, hip replacement or dental specialties.

If you think you can manage Portugal with your high school Spanish, forget it. You can’t. Portuguese is quite challenging. But English is widely spoken, especially in the Algarve because there are so many English expats.

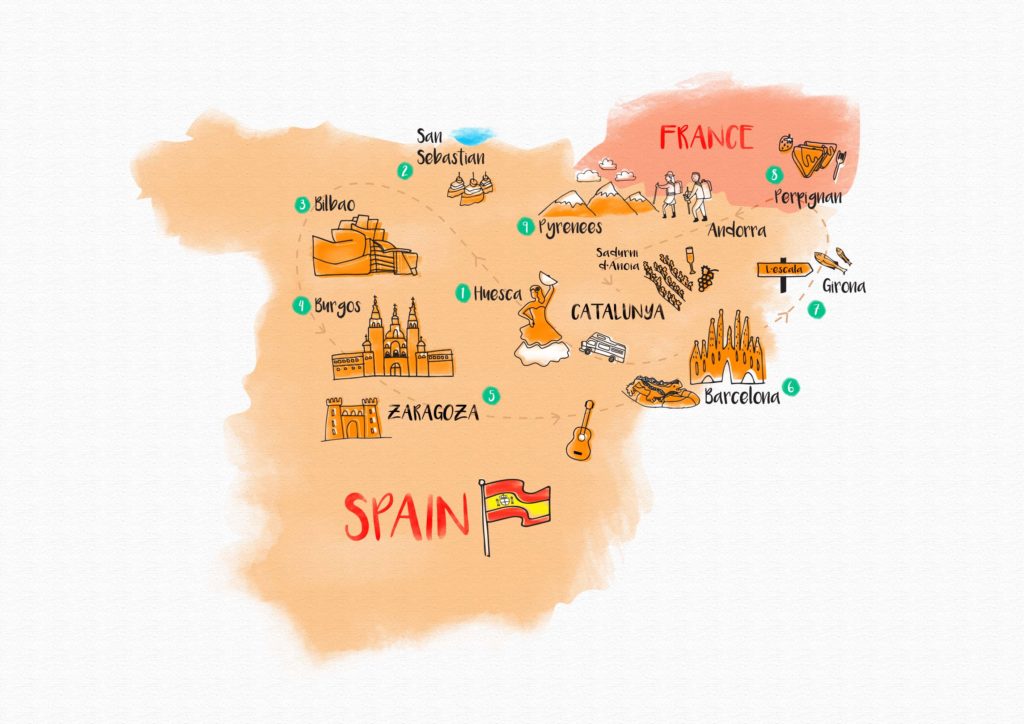

Spain

Another place with good weather, fairly low cost of living and a national health system available to all – or at least almost all (see below).

Another place with good weather, fairly low cost of living and a national health system available to all – or at least almost all (see below).

Non-European Union citizens (which includes Americans, Canadians and, now, the British) need a visado de residencia from the Spanish consulate to apply for residency upon arrival in Spain. For that, you’ll have to assure the Spanish government that you’re financially self-sustaining.

That would include a certificate from a public or private institution proving you will be receiving a regular pension, together with details of that pension; and/or proof of any other sources of income you have along with the details of any property you already own in Spain.

To access the public healthcare system – sistema nacional de salud – expats need a Spanish social security card and a medical card. (To get a social security number, you’d first have to sign on to the municipal register, the empadronamiento.)

Non-residents don’t qualify for universal healthcare, but there is a pay-in arrangement – the convenio especial – for those who aren’t otherwise able to access state healthcare. However, there’s a high demand for services and generally long waiting lists for treatments and operations. So many expats explore private health insurance.

Spain has exciting, multi-cultural cities like Madrid and Barcelona, but many retiring expats may prefer the Costa del Sol for its weather, excellent infrastructure and a proliferation of English-speaking service providers. The Benicassim, farther up the Spanish coast, offers a more authentic Spanish experience.

Spain, too, had its housing bubble, and there’s a shortage of affordable homes. Retirees may wish to delay intended house purchases until the housing bubbles have been fully resolved.

Andorra

This tiny principality, tucked into the Pyrenees Mountains between Spain and France, is getting a lot of play by expats who don’t need the sun and the beach. (Though an ability to ski helps.)

This tiny principality, tucked into the Pyrenees Mountains between Spain and France, is getting a lot of play by expats who don’t need the sun and the beach. (Though an ability to ski helps.)

However, the rising interest among foreigners has caused the Govern d’Andorra to be increasingly selective about whom it lets in. The procedure is rigorous and time-consuming, plus a linguistic challenge.

Residencias (residence permits) are available to applicants, retired or otherwise, as long as the applicants have (a) an address in the principality, and (b) a declaration to “become an active member of the community.”

Anyone spending more than 183 days in any calendar year in the country is considered a resident and requires a residencia. A resident must have a bona fide Andorran address, which does not include a hotel or post office box.

Everyone else is, by default, a tourist – meaning you may own property in Andorra but enjoy it only for a period of less than 183 days per year. (This rule has, apparently, not been strictly enforced in the past and there is at present no active policy of checking people in and out of the country.)

Here, as elsewhere, retirees must be able to demonstrate a private income sufficient to preclude their depending on employment within the principality. That means an annual income of not less than three times the minimum annual salary level stipulated by Andorran Social Security regulations (currently 9,402 euros, or $9,845).

In other words, an American must be able to prove earnings of at least $30,000 a year.

Individual foreign residents are required to deposit the sum of 24,000 euros (a little over $25,000) with the Andorran Finance Agency, plus another 6,000 euros (roughly $6,300) for a spouse and for any other dependent. The deposit is returnable on leaving Andorra or giving up the residencia.

The residencia is issued for a period of one year, renewable after the first year for three years at a time.

However, applying for the residencia is a fairly lengthy procedure and must be conducted in Catalan, the Spanish dialect that is Andorra’s official language (as well as in parts of Spain, France and even Italy).

In addition to establishing a local address, applicants must personally open a local bank account. (This cannot be arranged by a third party.)

A yellow application form must be completed, in Catalan, and submitted with original or notarized copies of your passport, birth certificate, marriage or divorce certificate, a Certificate of Good Conduct from your local police, a title deed or other proof of Andorran address, two passport-type photographs and proof of private health insurance. (At last, a benefit of the Affordable Care Act for Americans!)

For all of that, you get an Alpine lifestyle, freedom from any taxes, Andorran health-care services and (according to the British medical journal, The Lancet), the highest life-expectancy in the world. In 2013, the people of Andorra lived to be 81, on average.